Why Front-Loading Your 401(k) Might Be Your Most Expensive Financial Mistake

Zero-cost fix to maximize your employer match.

Your 401(k) optimization strategy could be leaving thousands of dollars on the table every year.

Earlier this year, I met with a tech executive who thought he was doing everything right. Smart guy, maxing out his 401(k) by June to get more time in the market.

But his optimization strategy was backfiring spectacularly—costing him $6,000 in employer matching every single year.

And here's the thing: he's not alone.

After review hundreds of 401(k) plans, I see this exact mistake happen constantly with high-earning professionals who think they're being strategic. It all comes down to a simple provision that most HR departments never mention.

Today, we're going to fix this expensive blind spot in your retirement strategy.

Here's what we'll cover:

Why front-loading your 401(k) might be backfiring

The $6,000 gap most high earners don't know about

How to protect your full employer match

A simple fix that works every time

Let's dive in and stop leaving free money on the table.

↓

Why Your 401(k) Optimization Strategy Might Be Backfiring

Here's the truth: front-loading your 401(k) can actually work against you.

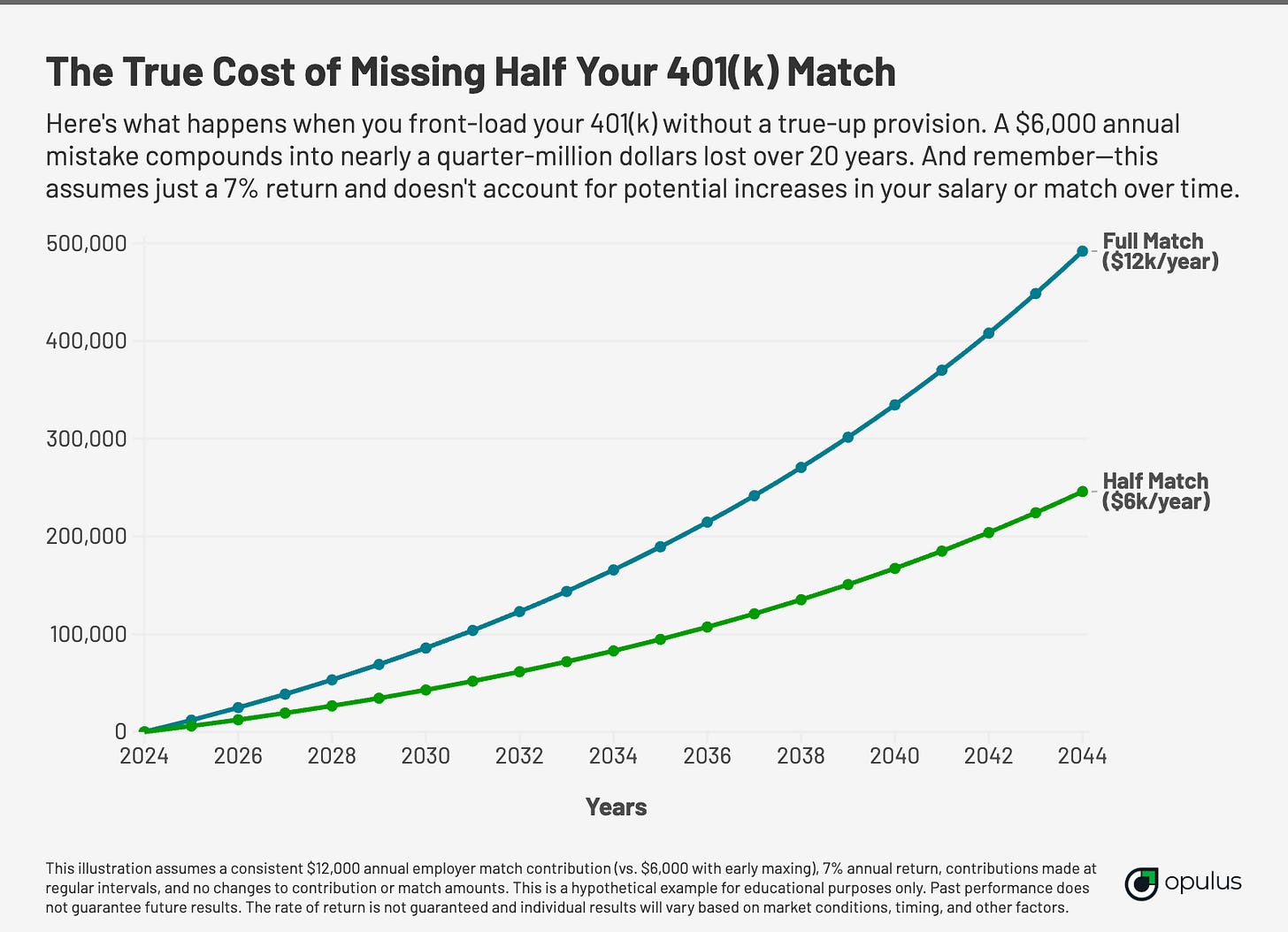

My client was making $300k annually with a 4% employer match—that's $12,000 in free money up for grabs. But by maxing out his 401(k) in early in June, he only got half.

The other $6,000? Gone. Every. Single. Year.

It all comes down to something called a "true-up provision." And whether your company has one could be the difference between maximizing your employer match or leaving thousands behind.

Here's Where $6,000 in Matching Went Missing

Most 401(k) mistakes cost hundreds of dollars—this one costs thousands, and it's hiding in plain sight.

A true-up provision is your company's promise to "make things right" at the end of the year. Think of it like a year-end accounting of what you should have received in matching funds, regardless of when you made your contributions.

Without it, your matching funds are strictly tied to your paycheck-by-paycheck contributions.

Let's break this down in real numbers.

Without a true-up provision:

You front-load your 401(k) by June

Hit your annual max of $23k (2024 limit)

Stop contributing because, well, you've maxed out

Your company stops matching because you've stopped contributing

Result → Six months of match money vanishes

But with a true-up provision:

Front-load all you want

Your company reconciles at year-end

You get your full match regardless of timing

The difference? A $6,000 annual mistake could compound into nearly $250,000 lost over 20 years. That's not just money—that's your future freedom we're talking about.

Protect Your Match Without Playing Games

Three minutes of research could save you THOUSANDS in matched funds this year.

Here's how to check if your plan has a true-up provision:

Call HR directly (the fastest route)

Review your Summary Plan Description (the official route)

Ask your 401(k) provider (the backup plan)

And here's the exact question to ask HR:

"Does our 401(k) plan include a true-up provision? If not, how are employer match contributions applied if I reach my annual contribution limit early?"

Pro tip: Screenshot their response.

Trust me—I've seen too many HR policies 'change' without notice.

Beyond The Quick Fix

Now, you might be thinking: "But what about getting my money in the market faster?"

Fair question. Yes, time in the market matters. But here's the thing—a guaranteed 100% return (your employer match) beats potential market gains every time.

The safe play? Take your annual 401(k) max ($23.5k in 2025) and divide it by 12 months.

It's not flashy. It's not complex. But it works.

That's it for today.

Here's what you learned today:

Front-loading your 401(k) without a true-up provision costs you thousands in matching funds

The timing of your contributions matters as much as the total amount

A simple monthly contribution strategy protects your full employer match

Three minutes of research could save you THOUSANDS this year

Your next step is simple: Take the exact question I provided above and send it to your HR department today. Screenshot their response, and adjust your contribution strategy accordingly.

PS: Forward this to someone you care about. The only thing worse than missing out on free money is watching your friends do the same.

Thanks for reading.

See you next week,

Whenever you're ready, there are 2 other ways we can help you:

Opulus Method Digital Course: Join 350+ students inside the Opulus Method. In just 90 minutes, learn a proven system to secure your financial freedom without sacrificing your lifestyle.

Join Opulus as a Client: We'll build your personalized strategy to reduce taxes, boost your income, and grow your wealth. Live life on your terms—we'll execute the financial strategy to get you there.

Opulus, LLC (“Opulus”) is a registered investment advisor in Pennsylvania and other jurisdictions where exempted. Registration as an investment advisor does not imply any specific level of skill or training.

The content of this newsletter is for informational purposes only and does not constitute financial, tax, legal, or accounting advice. It is not an offer or solicitation to buy or sell any securities or investments, nor does it endorse any specific company, security, or investment strategy. Readers should not rely on this content as the sole basis for any investment or financial decisions.

Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. There is no guarantee that any investment strategies discussed will result in profits or avoid losses.

All information is provided "as-is" without any warranties, express or implied. Opulus does not warrant the accuracy, completeness, or reliability of the information presented. Opinions expressed are those of the authors, Ryan Greiser and Francis Walsh, and are subject to change without notice.

Opulus is not responsible for any errors or omissions, nor for any direct, indirect, or consequential damages resulting from the use or reliance on this information. Use of the content is at your own risk. This content is not intended as an offer or solicitation in any jurisdiction where such an offer or solicitation would be illegal.