What Viral HSA Posts Don't Tell You

The 4 trade-offs that can cost families six figures over 30 years.

Over the last few months, I’ve watched HSA content go viral on repeat.

“Ultimate tax hack!” Triple tax savings. Grows forever. Better than a Roth.

The posts rack up thousands of likes. The comments fill with people asking where to sign up.

And I get it. On paper, HSAs deliver everything promised.

But here’s what those viral posts don’t mention: To access an HSA, you must accept a High Deductible Health Plan. You’re not just choosing a savings account. You’re choosing a completely different healthcare cost structure.

The irony? You pay more out-of-pocket to access the tax savings.

After running the numbers for countless clients, here’s what most people miss:

There are 4 landmines. And most people don’t see them until it’s too late.

The mandatory trade-off

To get HSA access, you don’t just open an account. You accept an HDHP—a High Deductible Health Plan.

That’s not a minor detail. It’s a structural trade-off that changes how you pay for healthcare.

Traditional plans spread costs across premiums and copays. You pay more monthly, but your out-of-pocket exposure is predictable and capped low.

HDHPs flip the model. Lower premiums. Higher deductibles. You self-insure until you hit a threshold that can run $3,000 for individuals or $6,000 for families.

The tax savings are real. But they come with strings most viral posts never mention.

The 4 landmines most people miss

Landmine 1: The aggregate deductible trap

Here’s the one that catches families hardest.

Traditional plans use “embedded” deductibles. Coverage kicks in when any single family member hits their individual limit. One kid breaks an arm? You hit $1,500, and insurance starts covering.

HDHPs use “aggregate” deductibles. The entire family deductible must be met before coverage begins for anyone.

Real impact: If your family deductible is $6,000 and one kid hits $2,000 in expenses, insurance pays nothing. Not until the whole family hits $6,000 combined.

Families with multiple people needing care can pay 3-4x more out-of-pocket before their plan helps. That’s not a rounding error. That’s a different financial reality.

Landmine 2: The hidden cost multiplier

HDHPs apply deductibles to nearly everything: prescriptions, specialist visits, ER trips, imaging, lab work.

Traditional plans? Fixed copays that don’t count toward your deductible.

Example: Your kid takes a $1,000/month specialty medication.

PPO Plan:

$100 copay per month

Predictable, manageable cost

HDHP:

Full $1,000/month until you hit your deductible

For a $3,000 individual deductible, that’s three months at full retail before insurance kicks in

The math changes fast when medications or specialists are in the mix.

Landmine 3: The coverage restriction problem

To maintain HSA eligibility, you can’t have any other disqualifying health coverage. Not some. Any.

This disqualifies you:

Secondary coverage on your spouse’s plan

Medicaid coverage

Certain FSAs or HRAs

These aren’t hypothetical edge cases. They’re situations that happen to real people trying to optimize across life transitions.

The tax savings come with strings. Make sure you’re not already holding coverage that disqualifies you.

Landmine 4: The tax math paradox

This is the one that surprised me most when I started running projections for clients.

Even with disciplined saving and triple tax benefits, the math doesn’t always work in favor of the HDHP.

Research from Michael Kitces tested this head-to-head. Person in the 22% tax bracket. Saves $4,300/year in an HSA for 30 years. Invests at 8%. Result: $719,000 tax-free.

Same person with a PPO plan saves $2,307 more per year on premiums and out-of-pocket costs combined. Invests that $6,607/year in a taxable brokerage account. Result: $874,000 after-tax.

PPO beats HDHP + HSA by $155,000 over 30 years. That’s $63,000 in today’s dollars.

The gotcha? If your medical cost savings from the traditional plan outpace the HSA tax benefits, you lose. And for families with ongoing care needs, that’s exactly what happens.

So when do HSAs actually make sense?

When all of these conditions align at once:

High income

Low medical expenses

Long time horizon

Ability to max-fund the account every year and never touch it

If you can self-insure and maximize the tax arbitrage, HSAs are powerful. The tax-free growth compounds beautifully if you leave the money untouched for decades.

But that’s the qualifier most advice leaves out. You need to be able to afford full retail healthcare costs while simultaneously maxing the HSA contribution. Most families can’t do both.

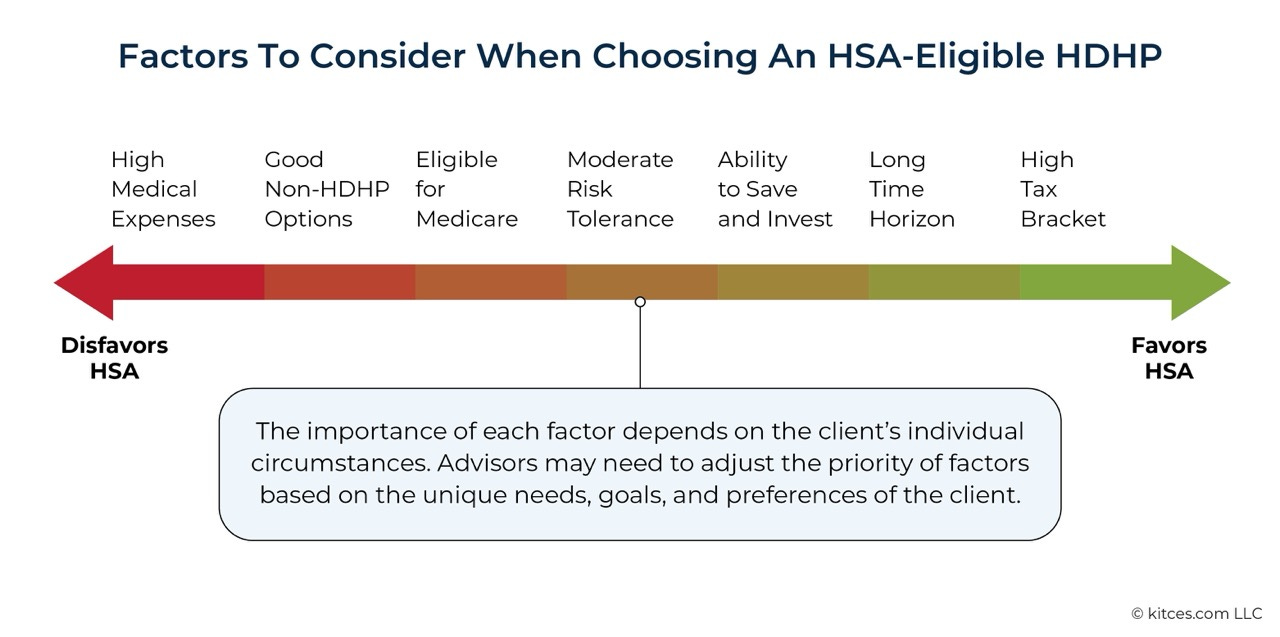

The factors that favor HSAs—high tax bracket, long time horizon, ability to save and invest—need to outweigh the factors working against them. High medical expenses, good non-HDHP options, and moderate risk tolerance all push the math in the other direction.

No single factor decides it. But when you map your situation across this spectrum, the picture becomes clearer.

Here’s the framework

Compare the full picture for your situation. Not generic advice. Your numbers.

Run these three numbers for yourself:

Annual premium difference (HDHP vs. traditional plan)

Expected out-of-pocket costs based on your actual medical usage

Tax savings from both structures

Family size matters. Prescription needs matter. Medical history matters more than the tax code.

The HSA isn’t a stealth IRA for everyone. It’s a stealth IRA for people who can afford to self-insure and maximize the tax arbitrage.

Know which camp you’re in.

That’s it.

The next time you see a viral HSA post rack up thousands of likes, remember what’s missing.

The triple tax savings are real. The tax-free growth is powerful. But the viral posts stop at the benefits and skip the trade-offs.

You’re not choosing between a good account and a great account. You’re choosing between two completely different ways to pay for healthcare. One protects you from costs up front. The other makes you self-insure first.

For some people—high earners with low medical expenses and long time horizons—the HDHP structure works beautifully. The HSA becomes exactly what it’s marketed as: a stealth IRA with triple tax advantages.

For everyone else? The traditional plan might quietly outperform the “ultimate tax hack” by six figures over 30 years.

Run your numbers. Not the generic advice. Yours.

Thanks for reading. See you next week.

Whenever you’re ready, there are 2 other ways we can help you:

30-Day Strategy Sprint: Got a specific financial challenge holding you back? In just 30 days, we’ll tackle 1-3 of your biggest money roadblocks and hand you a personalized action plan. Perfect if you want expert guidance without a long-term commitment. Limited spots available.

Ongoing Wealth Partnership: We’ll work with you month after month to slash your taxes, find hidden income opportunities, and build lasting wealth. You set the life goals. We handle the financial strategy to get you there faster.

Opulus, LLC (“Opulus”) is a registered investment advisor in Pennsylvania and other jurisdictions where exempted. Registration as an investment advisor does not imply any specific level of skill or training.

The content of this newsletter is for informational purposes only and does not constitute financial, tax, legal, or accounting advice. It is not an offer or solicitation to buy or sell any securities or investments, nor does it endorse any specific company, security, or investment strategy. Readers should not rely on this content as the sole basis for any investment or financial decisions.

Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. There is no guarantee that any investment strategies discussed will result in profits or avoid losses.

All information is provided “as-is” without any warranties, express or implied. Opulus does not warrant the accuracy, completeness, or reliability of the information presented. Opinions expressed are those of the authors, Ryan Greiser and Francis Walsh, and are subject to change without notice.

Opulus is not responsible for any errors or omissions, nor for any direct, indirect, or consequential damages resulting from the use or reliance on this information. Use of the content is at your own risk. This content is not intended as an offer or solicitation in any jurisdiction where such an offer or solicitation would be illegal.

This is an excellent summary.

This is phenomenal analysis and hits hard on something most people don't realize untill its too late. That aggregate deductible trap is especially brutal for families with ongoing care needs since insurance literally pays nothing untill the entire family hits the threshold. The problem is social media rewards oversimplification, so all we see are the sexy tax benefits without any mention of the structural trade-offs. I've been maxing my HSA thinking I was winning, but now I'm gonna actually run these numbers for my situation.