Want that Porsche 911? Here's how to have it and build wealth.

And still put $34,609 back in your pocket every year.

Ever stared at a sleek Porsche 911 and thought: "One day that'll be in my garage"?

You work hard, earn good money, and dream about rewarding yourself with that perfect luxury car. But deep down, you worry it might derail your long-term financial goals.

Most high-earners end up making one of two mistakes: either buying the dream car and feeling guilty as their wealth-building stalls, or denying themselves any luxury while building a nest egg they never enjoy.

There's a smarter approach.

Last month, a client asked if buying a $138K Porsche 911 Cabriolet was "worth it." After running the numbers, we helped him save 95% of the cost while still letting him drive his dream car. Today, I’m going to share the we used to let him experience luxury without compromising his financial future.

Here's what we'll cover:

The true cost of luxury car ownership

How to enjoy your dream cars at 2% of the ownership cost

Why freedom over status wins when it comes to long-term satisfaction

A practical framework for balancing luxury experiences with wealth creation

Let's dive in.

Run The Real Numbers

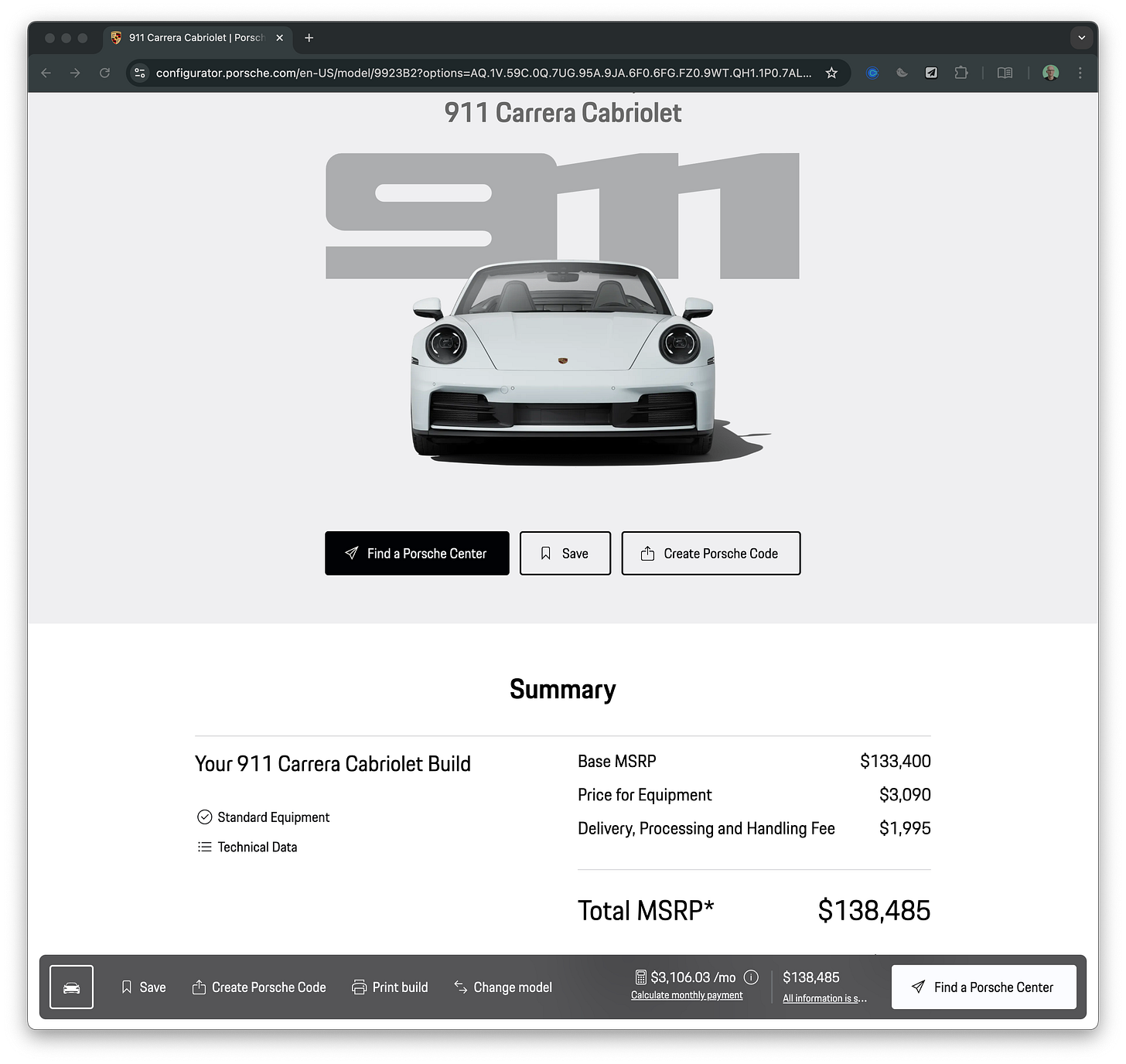

That $138,485 Porsche 911 Cabriolet is actually a $184,000+ commitment when you break it down.

Most luxury car buyers focus on the monthly payment while ignoring the true cost of ownership. Here's what my client discovered after we ran the numbers:

$3,106 monthly payment is $149,088 total over 48 months financed for the $138,485 purchase price

$10-20K maintenance over 5 years (depending on driving style)

$3,000-$5,000 annually for insurance—that's $15-25K over 5 years

And this is before we consider the 20-30% drop in value the moment you drive a new car off the lot—or the lost opportunity cost.

The math doesn't lie.

You're not spending the $138K sticker price – you're committing to over $184K out of pocket over just 5 years. That's life-changing money being poured into an asset that's actively losing value every day.

But what if there was a smarter way?

Hack Your Dream Car Experience

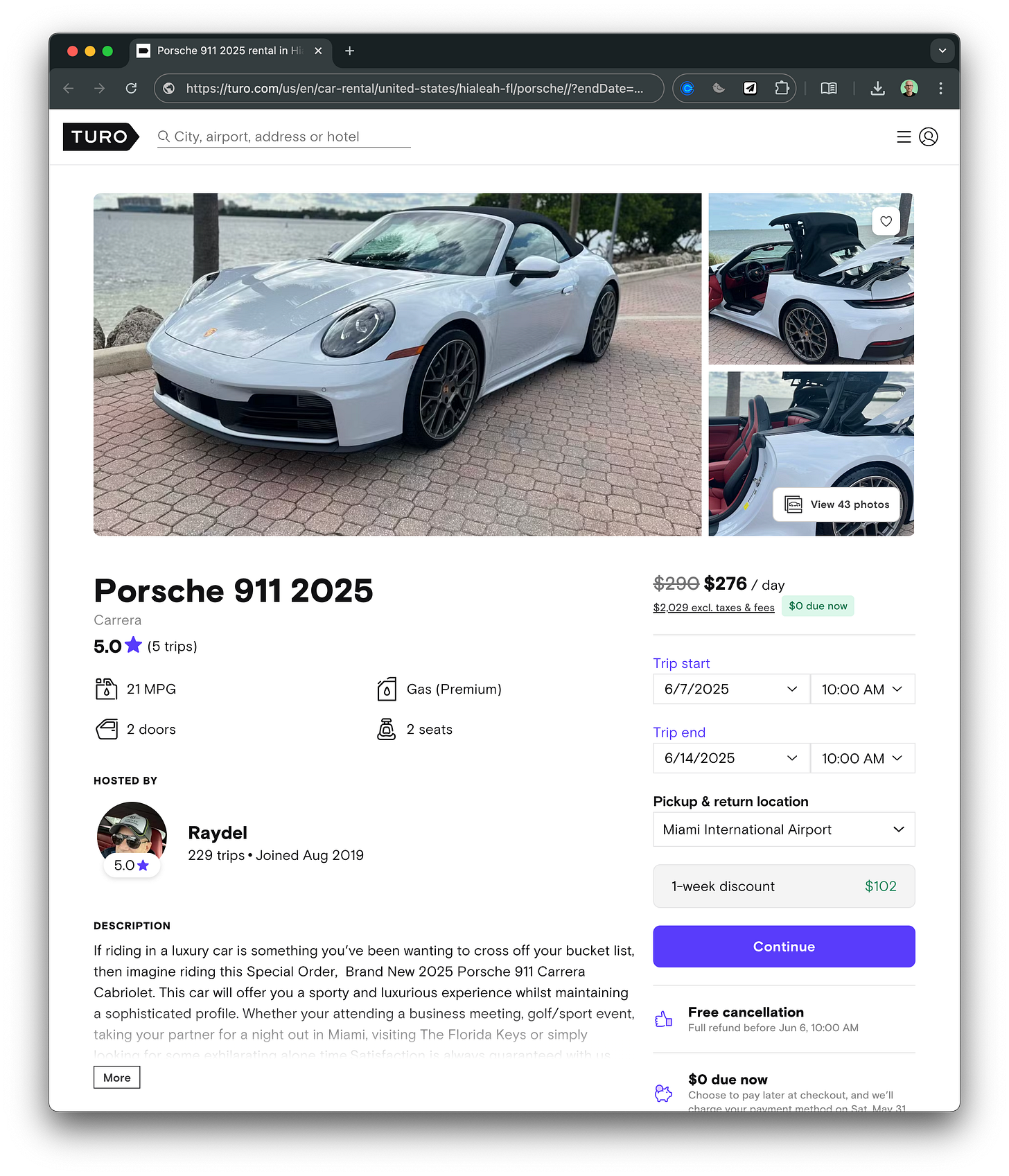

Want to drive that exact same Porsche 911? Rent it for one perfect week each year.

Cost: $2,209 (based on current luxury car rental rates) ↓

That's it. You get the full experience — the acceleration, the handling, the prestige, the attention — without the crushing financial burden. You scratch that luxury itch at just 6% of the ownership cost.

But here's where it gets even better: you're not locked into just ONE car.

Porsche 911 in Miami this year

Ferrari in Vegas next summer

Lambo in LA for that special anniversary

Different cars, different locations, zero maintenance headaches. Maximum flexibility with minimum financial commitment.

The psychology behind this strategy is powerful. The anticipation of your annual luxury week creates more genuine excitement than the 51 weeks of payments and maintenance stress that come with ownership.

Experiences create happiness. Obligations create stress.

What I've Learned About Cars

Here’s the surprising truth: one perfect week beats 51 weeks of worry.

Let's talk about what you could do with the $173,000+ you're saving over just 5 years:

Save for your kids financial future to give them a head start

Make a down payment on a cash-flowing rental property

Create lasting family memories with premium vacations

Stat that business you've been planning

Add to your investment portfolio

These are assets and experiences that appreciate in value and memory. They create lasting impact rather than just garage bragging rights.

I've seen this pattern hundreds of times with clients. The ones who choose freedom over financed status consistently build more wealth and report higher satisfaction with their financial decisions.

What's fascinating is how quickly the "I need to own it" feeling fades when you run the actual numbers. Our brains are wired to want status symbols, but they're equally wired to seek financial security.

When you show your brain that you can have both — the experience AND the security — it's a game-changer.

The Wealth-Freedom Framework

Building wealth through intentional trade-offs isn't about deprivation — it's about optimization.

The wealth secret isn't saying no to luxury. It's saying yes to:

Flexibility

Growth

Peace of mind

AND still enjoying the finer things

Let's put this in perspective:

Annual cost of Porsche ownership: $36,818

Annual cost of luxury rental strategy: $2,209

That's $34,609 back in your pocket.

This isn't just about cars. It's about creating a framework that balances your passions and desires with practical financial wisdom.

What other "ownership traps" might be holding your wealth hostage?

Boats?

Luxury watches?

Vacation homes used three weeks a year?

Look for areas where you can convert a high-cost ownership model into a high-joy, low-cost experience model. Then redirect those savings into assets that actually grow and experiences you won’t forget..

This mindset shift — from owning status symbols to owning your financial future — is what separates those who look rich from those who actually become wealthy.

That's it.

You don't have to choose between luxury experiences and building wealth. With the right strategy, you can enjoy the best of both worlds.

Remember: The real luxury in life isn't showing off what you can buy — it's having the freedom to live life entirely on your own terms.

Thanks for reading. We’ll see you next week.

Whenever you're ready, there are 2 other ways we can help you:

Opulus Method Digital Course: Join 350+ students inside the Opulus Method. In just 90 minutes, learn a proven system to secure your financial freedom without sacrificing your lifestyle.

Join Opulus as a Client: We'll build your personalized strategy to reduce taxes, boost your income, and grow your wealth. Live life on your terms—we'll execute the financial strategy to get you there.

Opulus, LLC (“Opulus”) is a registered investment advisor in Pennsylvania and other jurisdictions where exempted. Registration as an investment advisor does not imply any specific level of skill or training.

The content of this newsletter is for informational purposes only and does not constitute financial, tax, legal, or accounting advice. It is not an offer or solicitation to buy or sell any securities or investments, nor does it endorse any specific company, security, or investment strategy. Readers should not rely on this content as the sole basis for any investment or financial decisions.

Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. There is no guarantee that any investment strategies discussed will result in profits or avoid losses.

All information is provided "as-is" without any warranties, express or implied. Opulus does not warrant the accuracy, completeness, or reliability of the information presented. Opinions expressed are those of the authors, Ryan Greiser and Francis Walsh, and are subject to change without notice.

Opulus is not responsible for any errors or omissions, nor for any direct, indirect, or consequential damages resulting from the use or reliance on this information. Use of the content is at your own risk. This content is not intended as an offer or solicitation in any jurisdiction where such an offer or solicitation would be illegal.