The Old Man in the Gym (And What It Taught Me About Money)

Last week, something happened at the gym that completely shifted my perspective on wealth.

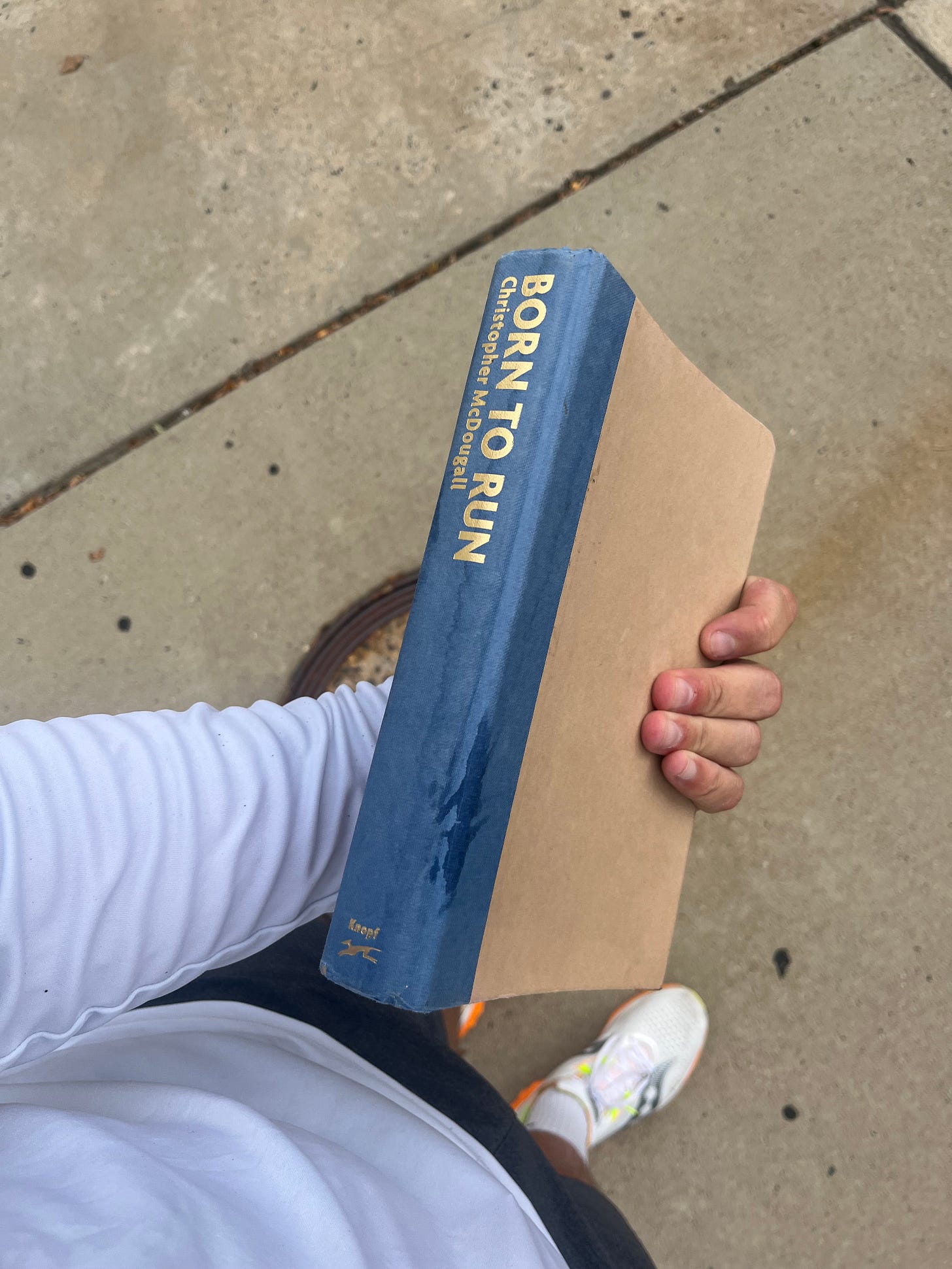

An old man walked up to my treadmill, dropped a book next to me; titled “Born to Run", and said: “That’s a gift for you.”

He told me he’d been watching me run and that I reminded him of himself 50 years ago. Then he started sharing stories - dozens of marathons and ultras back when ultra running wasn’t mainstream, with a personal best of 2:42 at 191 pounds.

Impressive numbers. But that’s not what got my attention.

As he left, he made one simple request: “When you’re done with that book - pass it on to the next person who deserves it.”

That moment hit me harder than any workout ever could. Because it wasn’t really about the book or even about running.

It was about legacy. And how most people completely miss the point of building wealth.

Here’s what that 10-minute conversation taught me about money, success, and what actually matters in the end:

In today’s newsletter, I’ll break down:

Why wealth without intentional legacy feels hollow (and what to do about it)

How to build financial habits and knowledge worth passing down

The 3 questions that reveal what you’re really leaving behind

Why encouragement might be more valuable than any investment advice

Let’s dig in ↓

The Fire You Build Shouldn’t End With You

That old man could have kept his running stories to himself. He could have just enjoyed his workout and gone home.

Instead, he chose to pass something forward.

In fitness, legacy means teaching, encouraging, or simply showing up as an example for the next generation. You demonstrate what’s possible through your own discipline and effort.

In finance, it works the same way - but it’s about more than just the final number in your bank account.

Real financial legacy means transferring:

Knowledge about how money actually works

Discipline around spending and saving decisions

Perspective during market volatility and financial stress

Values about what money should and shouldn’t do in your life

Think about it: Do the people you care about understand compound interest? Have they watched you make tough financial decisions under pressure? Do they see what responsible money management looks like day-to-day, not just during the highlight reel moments?

Because here’s the harsh reality: Money itself can disappear overnight through market crashes, bad decisions, or economic upheaval. But financial wisdom and discipline? Those habits get carried forward for generations.

The question isn’t just “How much will I leave behind?” It’s “What will they do with what I leave behind?”

The Power of Financial Encouragement

A few well-timed words can completely change someone’s financial trajectory.

That stranger’s encouragement about my running will stick with me longer than any race time or fitness goal I might hit. It reminded me that I’m capable of more than I think.

Financial encouragement works exactly the same way, and it’s probably more needed now than ever.

Maybe it’s explaining to a younger colleague why they should take the full 401(k) match (”That’s free money you’re leaving on the table”).

Maybe it’s encouraging your sibling to get life insurance before starting a family (”The best time to get coverage is when you don’t think you need it”).

Maybe it’s showing a friend how you automated your savings (”I don’t trust myself to save manually, so I made it impossible to fail”).

Here’s what most people don’t realize: the majority of Americans will never work with a financial advisor. They’ll never read investment books or attend financial planning seminars.

Their financial education will come from people they trust - which might be you.

Your willingness to share what you’ve learned about money, mistakes you’ve made, systems that have worked, could literally change someone’s entire financial future.

And unlike professional advice, encouragement from someone who knows and cares about them carries different weight. It’s personal. It’s believable. It sticks.

Legacy Lasts Longer Than Achievement

Achievements are impressive in the moment. But legacy echoes for decades.

That man’s 2:42 marathon time was genuinely remarkable. But what I’ll remember about him years from now isn’t his personal record - it’s how he used his experience to inspire someone else decades later.

In finance, “achievements” might include hitting your first $100K, reaching $1M net worth, or retiring early. These are important milestones that represent discipline and smart planning.

But true financial legacy goes deeper:

Estate planning that ensures your wealth gets used intentionally: Not just “who gets what,” but clear instructions about your values and hopes for how the money should impact their lives.

Supporting causes and communities that matter to you: Whether through current giving or planned charitable strategies, using wealth to create positive change beyond your immediate family.

Leaving clarity, not just cash: Detailed records, clear instructions, and most importantly, people who understand your financial philosophy and decision-making process.

The real victory isn’t just what you accumulate over your lifetime - it’s how your money continues creating positive impact after you’re no longer around to direct it.

The 3 Legacy Questions That Change Everything

One day, we’ll all be the old man in the gym—looking back on decades of effort, choices, and accumulated wisdom.

The question is: What will we have to pass forward?

Before that day comes, ask yourself these three questions:

1. Who will be genuinely better off because I built this wealth? Not just financially better off, but actually improved in meaningful ways. Will your financial legacy create opportunities, relieve stress, or enable your loved ones to pursue purposes they couldn’t otherwise afford?

2. What financial habits and knowledge will outlast me? Are you actively teaching the people you care about how to think about money, make financial decisions, and build wealth themselves? Or are you just planning to hand them money without the wisdom to manage it?

3. Am I spending enough time passing it on today? Legacy isn’t just about what happens after you’re gone. It’s about the conversations you’re having now, the example you’re setting daily, and the encouragement you’re giving to people who need to hear it.

These aren’t just philosophical questions. They’re strategic ones that should influence how you structure your estate plan, how you talk about money with family, and how you think about your role in other people’s financial journeys.

Bottom Line: Impact Over Accumulation

Wealth, like fitness, isn’t ultimately about personal records.

It’s about how your effort, discipline, and example create ripple effects that extend far beyond your own life.

Money without intentional legacy is just numbers on a statement. Money with thoughtful legacy becomes a tool for multi-generational impact.

The old man in the gym understood something crucial: The best achievements are the ones that inspire others to achieve more than they thought possible.

Your wealth can do the same thing.

When you’re done building it - pass it on.

See you next week.

Whenever you’re ready, there are 2 other ways we can help you:

30-Day Strategy Sprint: Got a specific financial challenge holding you back? In just 30 days, we’ll tackle 1-3 of your biggest money roadblocks and hand you a personalized action plan. Perfect if you want expert guidance without a long-term commitment. Limited spots available.

Ongoing Wealth Partnership: We’ll work with you month after month to slash your taxes, find hidden income opportunities, and build lasting wealth. You set the life goals. We handle the financial strategy to get you there faster.

Opulus, LLC (“Opulus”) is a registered investment advisor in Pennsylvania and other jurisdictions where exempted. Registration as an investment advisor does not imply any specific level of skill or training.

The content of this newsletter is for informational purposes only and does not constitute financial, tax, legal, or accounting advice. It is not an offer or solicitation to buy or sell any securities or investments, nor does it endorse any specific company, security, or investment strategy. Readers should not rely on this content as the sole basis for any investment or financial decisions.

Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. There is no guarantee that any investment strategies discussed will result in profits or avoid losses.

All information is provided “as-is” without any warranties, express or implied. Opulus does not warrant the accuracy, completeness, or reliability of the information presented. Opinions expressed are those of the authors, Ryan Greiser and Francis Walsh, and are subject to change without notice.

Opulus is not responsible for any errors or omissions, nor for any direct, indirect, or consequential damages resulting from the use or reliance on this information. Use of the content is at your own risk. This content is not intended as an offer or solicitation in any jurisdiction where such an offer or solicitation would be illegal.