The Teen Tax-Free Strategy 90% of Parents Never Hear About

The legal strategy that lets kids spend everything while parents build fortunes

Your teenager just finished their first summer job. You watched them cash their first check—pride in their eyes, maybe a smirk.

Then they blew it all in two weeks.

You know they should be saving for the future. But forcing them to hand over their hard-earned cash? That’s a guaranteed way to kill their motivation — and maybe your relationship.

Most parents miss this: there’s an IRS rule that lets you have your cake and eat it too. Your kid gets to spend their money. You build their retirement wealth. Everyone wins.

Here’s how smart parents are turning summer jobs into million-dollar retirement accounts. The strategy is legal, simple, and shockingly effective.

In this newsletter, you’ll discover:

The IRS rule that lets anyone fund your kid’s retirement

The 11-year roadmap from $0 to $1.7 million

The magic of compound interest

Implementation steps you can take this week

Four compliance requirements you can’t mess up

Let’s turn those summer paychecks into retirement millions. Here’s the rule that makes it all possible:

The IRS Rule That Lets Parents Fund Kids’ Retirement

The IRS accidentally built a loophole that rewards parents for their kids’ bad spending habits.

It sounds absurd—but it’s perfectly legal. Here’s how it works:

Most parents think the only way to fund their kid’s retirement is to force them to save their own money.

The IRS has a different idea. Here’s the rule that flips everything on its head: Your kid needs earned income to qualify for a Roth IRA, but the IRS doesn’t care who makes the contribution.

Think about that for a second.

Your daughter earns $2,000 this summer. She can keep every dollar. You can contribute $2,000 to her Roth IRA. The IRS counts her earnings as the qualification, your money as the funding.

It gets better.

Grandparents can contribute. Aunts and uncles too. Anyone can fund that Roth IRA as long as total contributions don’t exceed what your kid actually earned.

This isn’t a hack or gray area. It’s exactly how the system was designed to work.

But here’s the thing: you don’t have to go all-or-nothing. Some parents want their kids to have skin in the game and contribute part of their earnings too. That’s completely valid.

The key is understanding the rules, knowing your kid’s psychology around money, and making the best decision for your family. Whether you match dollar-for-dollar or split it 50/50, you’re still creating massive long-term wealth.

Pro tip: I find that kids are more motivated to work summer jobs when they get to spend a portion of their earnings while parents fund the Roth. They see current rewards for their effort while building invisible wealth.

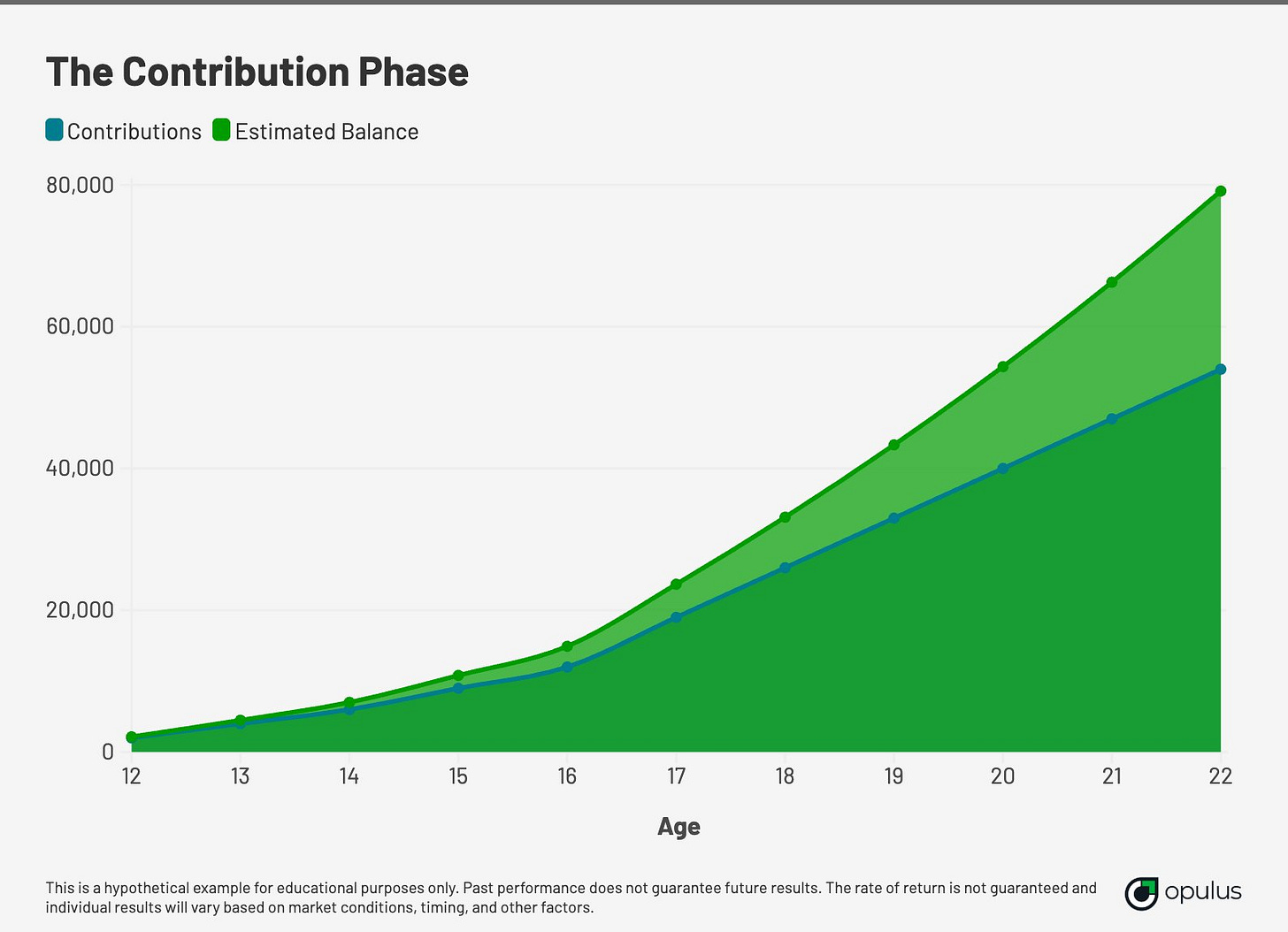

The 11-Year Millionaire Roadmap

Here’s what happens when you start early and stay consistent.

Ages 12-14: Your kid makes $2,000 per summer. You match it. Three years = $6,000 total.

Ages 15-16: Summer jobs get bigger. $3,000 per year. You match it. Two years = $6,000 more.

Ages 17-22: Now they can work year-round. $7,000 annual contributions (hitting the IRS limit). Six years = $42,000.

Total invested by age 22: ~$79,000 at 8% growth over 11 years.

Now comes the magic of compound growth.

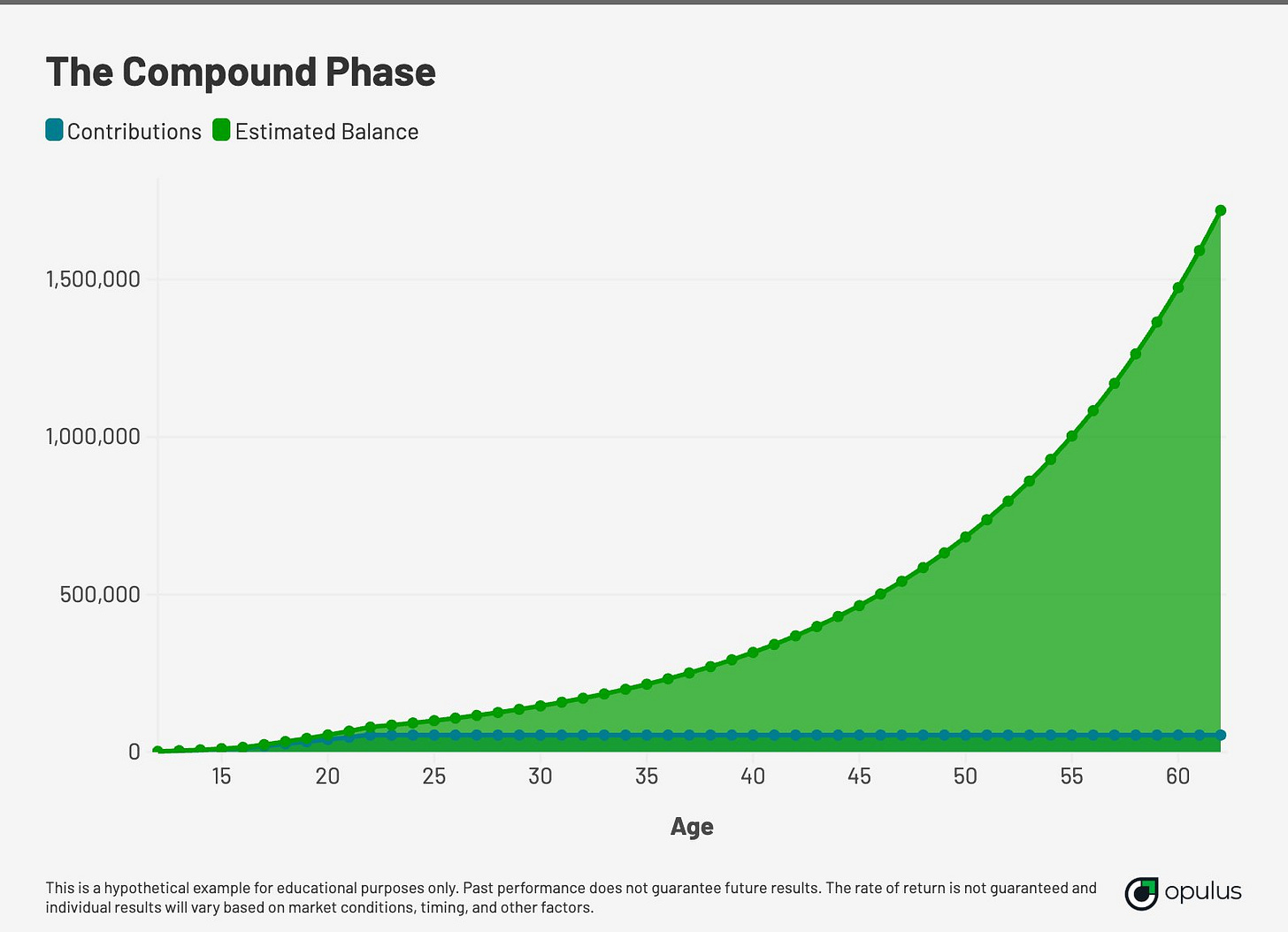

The Compound Growth Magic

That $79,000 sits untouched from age 22 to 62.

At 8% annual returns, it could reach $1.7 million—a portfolio with the potential of growing $136,000 per year at that point.

40 years of growth. Zero additional contributions needed.

Think about this: Your kid works summer jobs for 11 years. Gets to spend every dollar they earn. Could almost be a multi-millionaire at 62. All because you matched their work with Roth contributions.

But here’s the real kicker: those early contributions do the heavy lifting. The $6,000 you invest when your kid is 12-14? That alone grows to over $400,000 by retirement.

Compound interest doesn’t just reward people who save. It rewards people who start early.

It’s the closest thing to financial time travel that exists. You’re not just investing money—you’re buying decades of freedom your kid doesn’t even know to dream about yet.

The Four Rules You Cannot Break

Every great strategy has guardrails, and this one has four.

Rule 1: Earned income only. The work must generate reportable earned income. Birthday gifts and allowances don’t qualify. Work with your accountant to ensure your child’s income meets IRS requirements.

Rule 2: Contributions can’t exceed earnings. If your kid makes $1,500, that’s your contribution ceiling. Not a penny more.

Rule 3: Annual limits apply. 2025 cap is $7,000 per year, but remember Rule 2 trumps this. Most young kids won’t hit the limit anyway.

Rule 4: You control the account. You open a custodial Roth IRA in their name. Most major brokerages (Fidelity, Schwab, Vanguard) offer these accounts with $0 minimums and low-cost index fund options. You manage it until they reach adulthood (usually 18 or 21, depending on your state).

Follow these four rules and you’re good. Break them and the IRS won’t be pleased.

That’s it.

Most parents see their teenager’s summer job and think about spending money. A few hundred bucks for clothes, games, maybe a car payment.

Smart parents see the same summer job and think about generational wealth. While their friends’ kids blow through paychecks on temporary pleasures, these parents see 11 years of matched contributions turning into $1.7 million retirement accounts. They see compound interest doing the heavy lifting while their kids get to be kids.

The choice isn’t really about money. It’s about time. Every summer you wait is decades of compound growth you can’t get back.

Your kid is going to work anyway. You’re going to spend money on them anyway. This strategy just redirects both toward their financial future instead of immediate consumption.

The IRS gave you the rule. The math proves it works.

But the real power isn’t in the money. It’s in what it teaches.

You’re showing your kid what generational wealth actually looks like. That discipline, that time horizon, that mindset—those are the habits that compound forever.

See you next week.

Whenever you’re ready, there are 2 other ways we can help you:

30-Day Strategy Sprint: Got a specific financial challenge holding you back? In just 30 days, we’ll tackle 1-3 of your biggest money roadblocks and hand you a personalized action plan. Perfect if you want expert guidance without a long-term commitment. Limited spots available.

Ongoing Wealth Partnership: We’ll work with you month after month to slash your taxes, find hidden income opportunities, and build lasting wealth. You set the life goals. We handle the financial strategy to get you there faster.

Opulus, LLC (“Opulus”) is a registered investment advisor in Pennsylvania and other jurisdictions where exempted. Registration as an investment advisor does not imply any specific level of skill or training.

The content of this newsletter is for informational purposes only and does not constitute financial, tax, legal, or accounting advice. It is not an offer or solicitation to buy or sell any securities or investments, nor does it endorse any specific company, security, or investment strategy. Readers should not rely on this content as the sole basis for any investment or financial decisions.

Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. There is no guarantee that any investment strategies discussed will result in profits or avoid losses.

All information is provided “as-is” without any warranties, express or implied. Opulus does not warrant the accuracy, completeness, or reliability of the information presented. Opinions expressed are those of the authors, Ryan Greiser and Francis Walsh, and are subject to change without notice.

Opulus is not responsible for any errors or omissions, nor for any direct, indirect, or consequential damages resulting from the use or reliance on this information. Use of the content is at your own risk. This content is not intended as an offer or solicitation in any jurisdiction where such an offer or solicitation would be illegal.

Okay but who's hiring 12 year olds for summer jobs?