The Hidden Triple Tax-Advantaged Wealth Engine

How to unlock the full potential of your HSA in 2025

Think an HSA is just for doctor’s bills? Think again.

Your Health Savings Account (HSA) might just be the most powerful—and underutilized—wealth-building tool in your financial arsenal. With a triple tax advantage, it can function as both a healthcare safety net and a retirement powerhouse.

Yet, many people are leaving money on the table simply because they don’t fully understand how HSAs work or how to maximize their benefits.

Here’s what we’ll cover today:

The 2025 HSA contribution limits and rules

Why the HSA is a powerhouse for tax-advantaged savings

Strategic insights to integrate your HSA into your financial plan

How to use your HSA for tax-free growth and retirement planning

Hidden opportunities you might be missing

Let’s unlock the full potential of your HSA.

The Triple Tax Advantage of an HSA

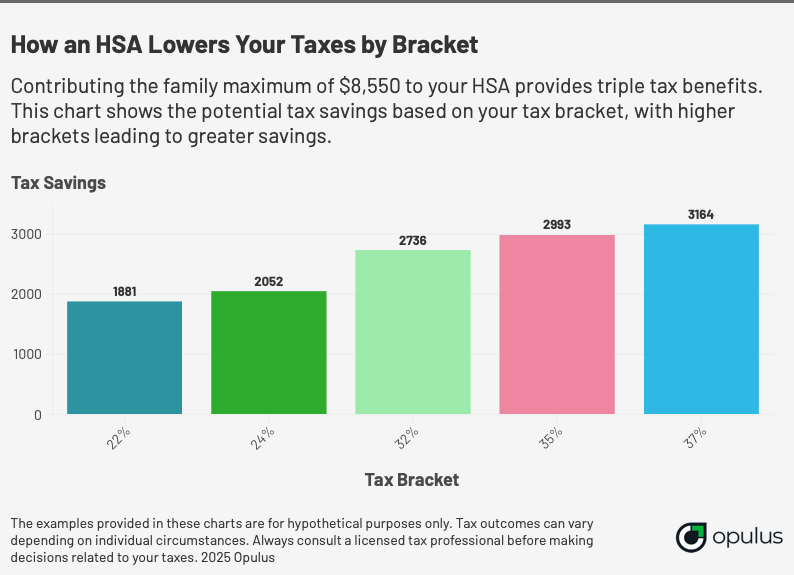

An HSA isn’t just a medical savings account—it offers three distinct tax advantages that make it a cornerstone of smart financial planning:

Contributions are tax-deductible. Every dollar you contribute reduces your taxable income.

Earnings grow tax-free. Invested funds grow without being taxed along the way.

Withdrawals for medical expenses are tax-free. Unlike most other accounts, there’s no tax hit when you use the funds for qualified medical costs.

No other savings vehicle offers all three benefits. Pretty awesome!

Updated for 2025: Contribution Limits and Eligibility

To get the most out of your HSA, you need to know the rules. For 2025, here’s what you should keep in mind:

Contribution Limits:

$4,300 for individuals.

$8,550 for families.

Additional $1,000 catch-up contribution if you’re 55 or older.

Eligibility Criteria:

You must be enrolled in a High Deductible Health Plan (HDHP):

Minimum deductible: $1,650 (individual), $3,300 (family).

Maximum out-of-pocket: $8,300 (individual), $16,600 (family).

You can’t be enrolled in Medicare.

You can’t be claimed as a dependent on someone else’s tax return.

Strategic HSA Moves to Maximize Wealth

1. Integrate Your HSA Into Your Comprehensive Financial Plan

Think of your HSA as part of your broader financial strategy, not just a standalone account. While it offers unmatched tax benefits, its role depends on your financial priorities. For example:

Employer Match in a 401(k): If your employer offers a match, prioritize contributing enough to capture it before maxing out your HSA.

Roth IRA Contributions: For those eligible, consider balancing HSA and Roth IRA contributions for long-term growth.

2. Maintain a Cash Buffer for Emergencies

While investing your HSA funds for growth is smart, you don’t want to be caught short during an emergency.

Best Practice: Keep at least one year’s worth of your deductible in cash or a money market fund within your HSA. This ensures liquidity for immediate medical needs.

3. Invest for Long-Term Growth

After building a cash buffer, treat your HSA like a retirement account. Invest the remaining funds in diversified options such as index funds or ETFs to benefit from compounding growth.

Example: Contribute $4,300 annually (self-only) and invest at a 7% annual return. In 20 years, your HSA could grow to over $208,000—all tax-free if used for medical expenses.

4. Maximize Tax-Free Withdrawals

Pay for medical expenses out of pocket whenever possible and save the receipts. Why?

You can reimburse yourself years later, tax-free, for any qualified medical expense incurred after opening your HSA.

This strategy allows your funds to grow untouched, compounding for decades.

5. Plan for Retirement

After age 65, HSAs become even more flexible:

Withdrawals for non-medical expenses are no longer penalized (though they’re taxed as income, like a Traditional IRA).

Medical withdrawals remain tax-free, making your HSA a dual-purpose retirement and healthcare account.

Additional Opportunities You Might Be Missing

1. Hidden Qualified Medical Expenses

Did you know your HSA can cover more than just doctor visits? Eligible expenses include:

Dental care

Vision care (glasses, contact lenses, eye exams)

Over-the-counter medications

Alternative treatments like acupuncture

For a full list, consult IRS Publication 502.

2. Legacy Planning

When it comes to estate planning, HSAs require careful consideration:

If your spouse is the beneficiary, the HSA transfers tax-free.

For other heirs, the account balance is taxable as income upon inheritance.

Strategy: Spend down your HSA in retirement to maximize its tax-free benefits.

3. Tax Nuances for High Earners

For those in high tax brackets, HSAs are an excellent way to shelter income.

Contributions reduce both federal and (in most states) state taxes.

Caveat: If you live in California or New Jersey, earnings on your HSA may still be subject to state tax.

How to Take Action Today

Evaluate Your Eligibility: Are you enrolled in an HDHP? If not, consider switching during open enrollment.

Maximize Your Contributions: Adjust your 2025 budget to contribute the maximum allowable amount.

Invest Your HSA Funds: If you’re not already investing your HSA, set up an investment strategy tailored to your risk tolerance.

Save Your Receipts: Maintain detailed records of all qualified medical expenses to unlock future tax-free reimbursements.

Key Takeaways

HSAs offer unmatched tax benefits, making them a cornerstone of wealth-building strategies.

With the right approach, your HSA can function as both a healthcare safety net and a powerful retirement account.

Small changes to how you contribute, invest, and use your HSA can lead to substantial long-term rewards.

PS: Share this newsletter with someone who could benefit from these insights—because the only thing worse than leaving money on the table is watching someone else do the same.

Whenever you're ready, there are 2 other ways we can help you:

Opulus Method Digital Course: Join 350+ students inside the Opulus Method. In just 90 minutes, learn a proven system to secure your financial freedom without sacrificing your lifestyle.

Join Opulus as a Client: We'll build your personalized strategy to reduce taxes, boost your income, and grow your wealth. Live life on your terms—we'll execute the financial strategy to get you there.

Opulus, LLC (“Opulus”) is a registered investment advisor in Pennsylvania and other jurisdictions where exempted. Registration as an investment advisor does not imply any specific level of skill or training.

The content of this newsletter is for informational purposes only and does not constitute financial, tax, legal, or accounting advice. It is not an offer or solicitation to buy or sell any securities or investments, nor does it endorse any specific company, security, or investment strategy. Readers should not rely on this content as the sole basis for any investment or financial decisions.

Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. There is no guarantee that any investment strategies discussed will result in profits or avoid losses.

All information is provided "as-is" without any warranties, express or implied. Opulus does not warrant the accuracy, completeness, or reliability of the information presented. Opinions expressed are those of the authors, Ryan Greiser and Francis Walsh, and are subject to change without notice.

Opulus is not responsible for any errors or omissions, nor for any direct, indirect, or consequential damages resulting from the use or reliance on this information. Use of the content is at your own risk. This content is not intended as an offer or solicitation in any jurisdiction where such an offer or solicitation would be illegal.