The Doubt Influencers Sell You

How viral 401(k) skepticism could cost you $580K over 20 years

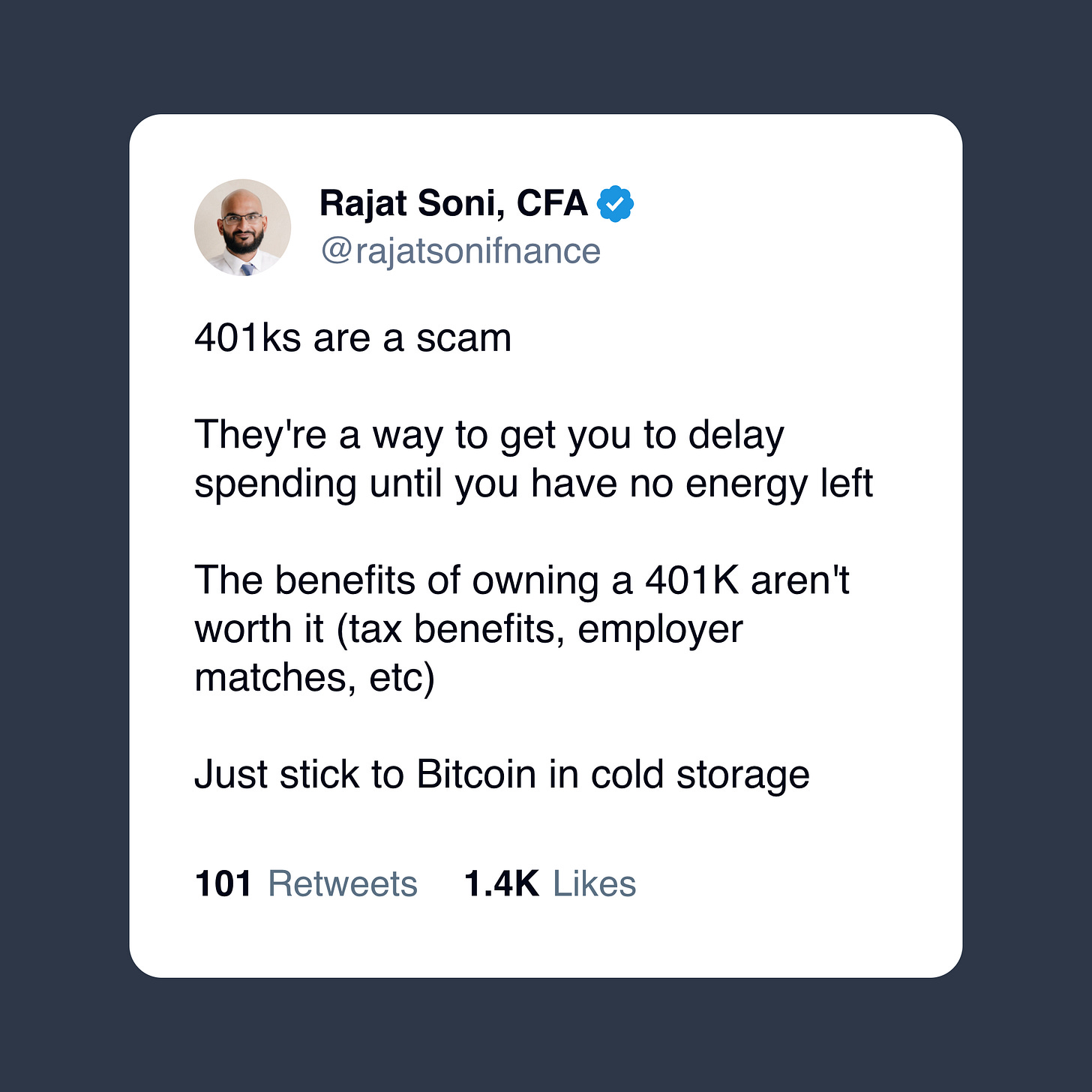

I was scrolling 𝕏 last week when I saw it again. An account with 130,000+ followers posted:

1,400+ likes. 142,000+ views. 208 comments.

I clicked through to read them.

One person wrote: “Imagine investing your cash into something that can just barely keep up with inflation, only to be told when you can or can’t use it. And if you use it early, you get taxed on it, thereby erasing all your gains. Such a scam.”

Another: “Took me a while to realize but I do now. My company just decoupled the percentage match so I am out.”

They’re not confused about the math. Someone convinced them not to trust it.

That’s manufactured doubt. And someone’s profiting from it.

Controversy goes viral. Math doesn’t. So you’re left wondering who to trust.

Follow the money

So why do smart people believe the “401(k) is a scam” narrative?

Because math doesn’t go viral. Controversy does.

A thread explaining compound interest and matching provisions gets 10 likes. A thread calling 401(k)s a scam gets 1,400+ likes, 142,000+ views, and lands the influencer a podcast interview.

And here’s what nobody tells you: these influencers aren’t making money from giving you good advice. They’re making money from your doubt.

The same voices telling you to skip your 401(k) are selling $47/month “financial freedom” communities and 1:1 coaching sessions for hundreds or thousands of dollars. The pitch is always the same: convince you the proven system is broken, then sell you the “alternative.”

Ask yourself what else they’re selling:

$997 courses on “escaping the system”

“Secret” real estate deals with 20% fees built in

Whole life insurance with 3-5% returns and 100% commissions

None of those offerings give you an instant 50-100% boost from an employer contribution on day one.

The advice isn’t designed to build your wealth. It’s designed to build their audience. Your confusion is their business model.

Here’s what the math actually looks like

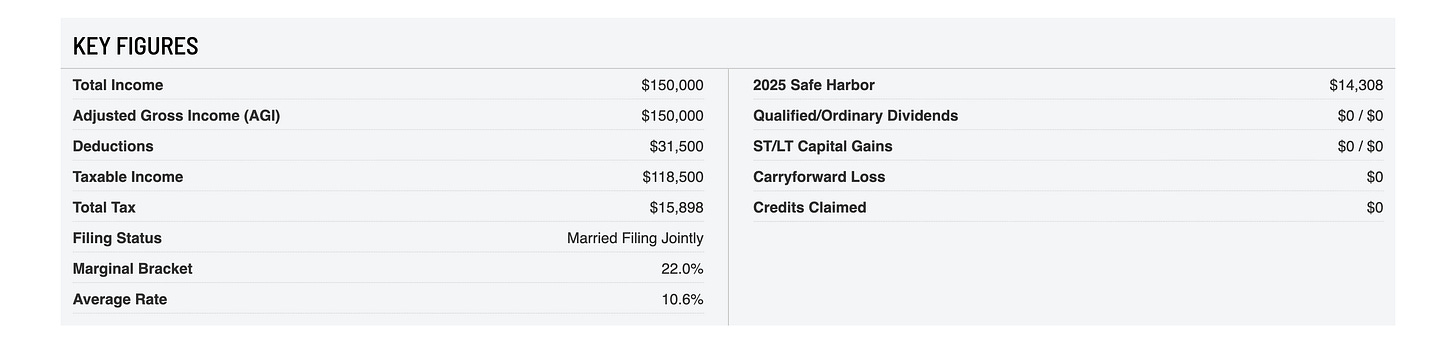

Let’s start with a couple making $150,000.

No 401(k) contribution? You pay $15,898 in federal taxes.

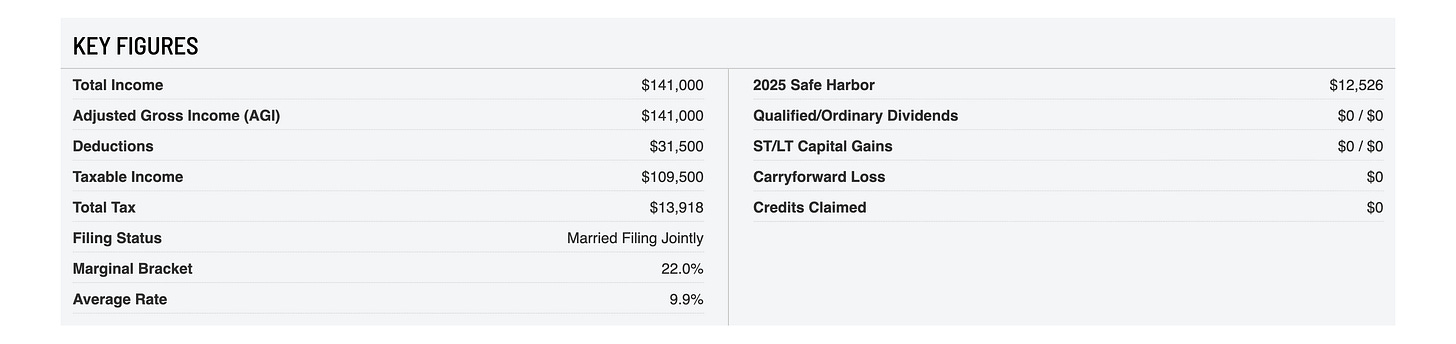

Contribute just $9,000 to get your employer’s 50% match? You pay $13,918 in federal taxes. That’s $1,980 less. Plus $4,500 in a match from your employer.

Total benefit year one: $6,480.

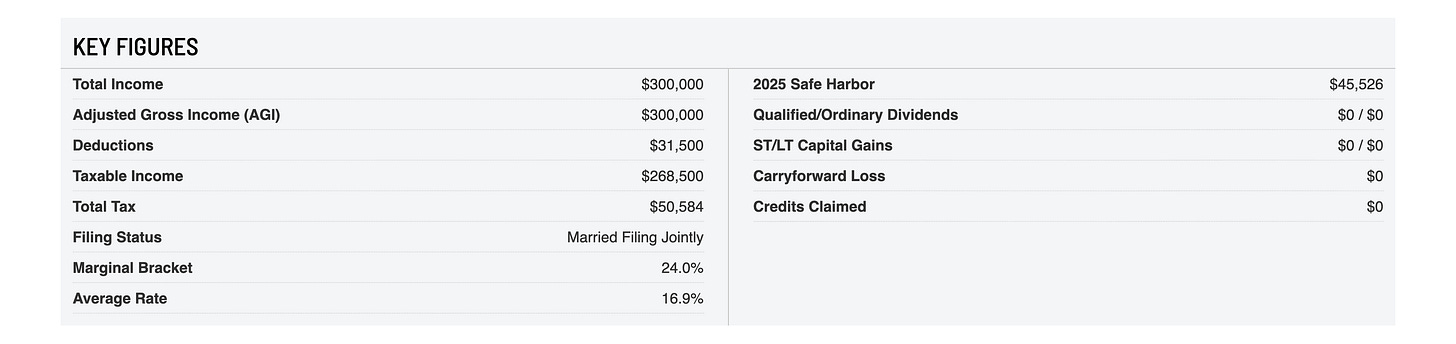

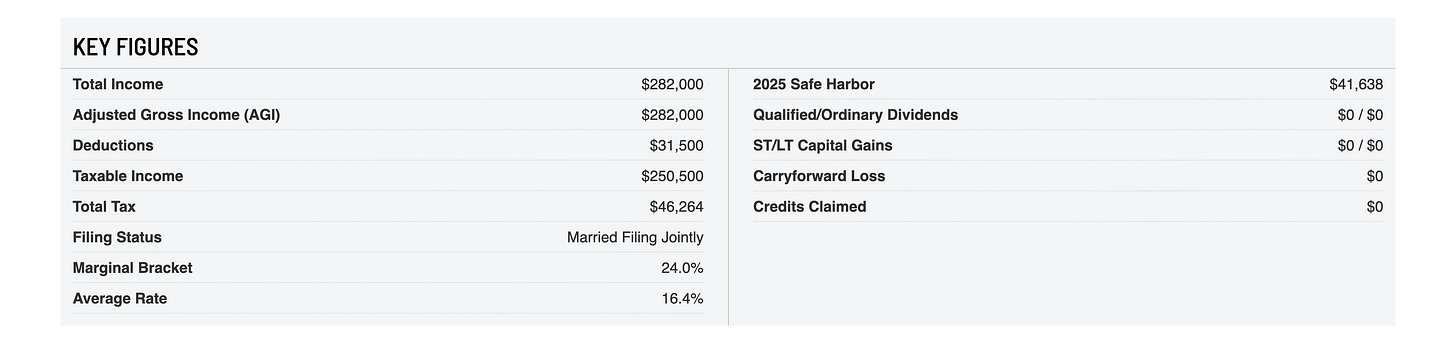

Now let’s look at $300,000.

No 401(k)? $50,584 in federal taxes.

Contribute $18,000? $46,264 in federal taxes. You save $4,320. Your employer adds $9,000 at 50% match.

That’s $13,320 in your pocket. Year one.

For perspective on that instant 50% boost from your employer match:

Angel investments: 20-30% if you’re fortunate

S&P 500 historical average: 10% annually

Real estate: 7-12% with significant work

High-yield savings: 4% right now

Nothing else comes close to this immediate benefit from an employer match. Not stocks. Not crypto. Not real estate. Not private equity.

It’s not a scam. It’s just math that gets lost in the controversy.

What that doubt actually costs you

Here’s what happens when you skip your 401(k) at a $300,000 salary.

Over 20 years—assuming 7% returns, 3% annual raises, and that same 50% match on 6% of your salary:

Lost tax savings: $116,080 est.

Lost employer matches: $241,833

Lost growth on employer matches: $222,471

Total missed opportunity: $580,384

Your numbers will vary. The pattern won’t.

Over 30 years? That gap only becomes bigger.

Almost a half million dollars in opportunity cost because someone on social media told you 401(k)s were “for suckers.”

That’s not a projection. That’s compound interest doing what it does when you give it time and guaranteed returns.

The people telling you to skip your 401(k) aren’t building wealth for 30 years. They’re building audiences for 30 days. They’ll be selling a different hot take by next quarter.

Your wealth doesn’t reset. Their content strategy does.

The objections are real, but the math still works

The “401(k) is a scam” crowd has two main arguments: fees and access.

Let’s handle both.

Objection 1: The fees are bleeding you dry

They’re not entirely wrong. Annual management costs—typically 0.49% (BrightScope/ICI), but sometimes 1-2% in poorly structured plans—compound over decades. A 1.5% fee drag on a $100K portfolio growing at 7% can cost you over $300,000 across 40 years.

That’s real money going to Vanguard, Fidelity, and BlackRock instead of your retirement.

But here’s what that argument ignores: the instant 50% boost from your employer match.

Even with aggressive 1.5% fees, you start with a 50-100% gain on day one from the match. If your employer gives you $9,000, the fee takes $405 per year on a $27,000 balance. You’re still ahead by $8,595 in year one alone.

Over 20 years, even with high fees, the employer match plus tax savings still puts you ahead of skipping your 401(k) entirely.

The fee matters. The match matters more.

When do fees become a dealbreaker? If your plan charges high fees and offers terrible fund options, max your employer match first—then invest elsewhere. But don’t walk away from free money because the system isn’t perfect.

Objection 2: Your money is locked until you’re 59½

Not entirely true.

Five penalty-free ways to access 401(k) funds early:

Substantially Equal Periodic Payments (Rule 72t)

Rule of 55 (if you leave your employer at 55+)

Roth conversion ladder (for early retirement planning)

401(k) loans (borrow from yourself, pay yourself back)

Hardship withdrawals (specific qualifying circumstances)

You’re not always locked in. You just need to understand the rules.

When to look beyond your 401(k)

I’m not telling you to put every dollar into your 401(k).

Here’s when you should look beyond it:

After you’ve maxed your employer match. Always secure the free money first. Then consider diversifying into other strategies.

If your plan has truly terrible options. Fees over 1.5% plus limited fund choices? Max the match, then consider moving additional savings to a Roth IRA or taxable brokerage account.

For specific wealth-building goals. Early retirement strategies, real estate down payments, private investments—these all have their place. But they work better when you’re not leaving $9K+ per year on the table.

The goal isn’t 401(k) maximalism. It’s wealth optimization.

And optimization starts with not turning down guaranteed returns from a match because someone on social media needed engagement.

That’s it.

I still see these posts every month.

Different influencers. Same manufactured controversy. Same smart people in the comments announcing they’ve stopped contributing.

And every time, I think about what they’re walking away from. $116,000 in tax savings. $241,000 in employer matches. $222,000 in growth on free money. All because someone needed clicks.

The advice isn’t designed to build your wealth. It’s designed to build their platform.

You don’t have to fall for it.

If you’re with me: Log into your 401(k) portal and look at your current contribution rate, your employer’s match percentage, and whether you’re leaving free money on the table.

If you are, consider capturing it.

Ten minutes. Potentially hundreds of thousands in opportunity.

Thanks for reading. See you next week.

Whenever you’re ready, there are 2 other ways we can help you:

30-Day Strategy Sprint: Got a specific financial challenge holding you back? In just 30 days, we’ll tackle 1-3 of your biggest money roadblocks and hand you a personalized action plan. Perfect if you want expert guidance without a long-term commitment. Limited spots available.

Ongoing Wealth Partnership: We’ll work with you month after month to slash your taxes, find hidden income opportunities, and build lasting wealth. You set the life goals. We handle the financial strategy to get you there faster.

Opulus, LLC (“Opulus”) is a registered investment advisor in Pennsylvania and other jurisdictions where exempted. Registration as an investment advisor does not imply any specific level of skill or training.

The content of this newsletter is for informational purposes only and does not constitute financial, tax, legal, or accounting advice. It is not an offer or solicitation to buy or sell any securities or investments, nor does it endorse any specific company, security, or investment strategy. Readers should not rely on this content as the sole basis for any investment or financial decisions.

Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. There is no guarantee that any investment strategies discussed will result in profits or avoid losses.

All information is provided “as-is” without any warranties, express or implied. Opulus does not warrant the accuracy, completeness, or reliability of the information presented. Opinions expressed are those of the authors, Ryan Greiser and Francis Walsh, and are subject to change without notice.

Opulus is not responsible for any errors or omissions, nor for any direct, indirect, or consequential damages resulting from the use or reliance on this information. Use of the content is at your own risk. This content is not intended as an offer or solicitation in any jurisdiction where such an offer or solicitation would be illegal.

This is why you should fully understand the 401k structure for your specific employer.

Big assumption that you will receive 50% match at least. Seems like the return benefit comparison is not fair if you assume 0% match + high fees. Context on proper retirement planning for variable salary ranges is necessary as well (when it makes sense to use Roth vs pre-tax, backdoor strategies, IRAs, etc.). Limited investment options in plans are probably another deterrent. Investors today are much more interested and involved in their investments - being able to invest in any possible individual stock/fund in a brokerage account or IRA is much more enticing than only picking from a set of target date funds. Overall, 401ks provide a huge benefit, but I don’t think the argument of “good or bad” is as black and white as the industry makes it.