The Costly Oversight Six-Figure Earners Can’t Afford to Ignore

A friend of mine, a sharp, ambitious marketing executive, made this mistake. It cost her $12,000 in employer match contributions.

Every year, six-figure earners unknowingly leave thousands of dollars on the table when they switch jobs—just because they don’t understand their employer’s vesting schedule.

If you’re a high earner and not familiar with vesting schedules, you could be making the same costly mistake.

Let’s break it down.

The Cost of Leaving Too Early

My friend thought she was making a smart financial move by accepting a new role with a higher salary. She had been with her previous employer for two years and had diligently contributed to her 401(k). Her company had even matched $24,000 of her contributions.

But there was a catch.

Her employer had a 4-year vesting schedule. By leaving after only two years, she was only 50% vested. Instead of keeping the full $24,000 match, she only walked away with $12,000.

The remaining $12,000? Gone forever.

Broader Financial Implications of Vesting

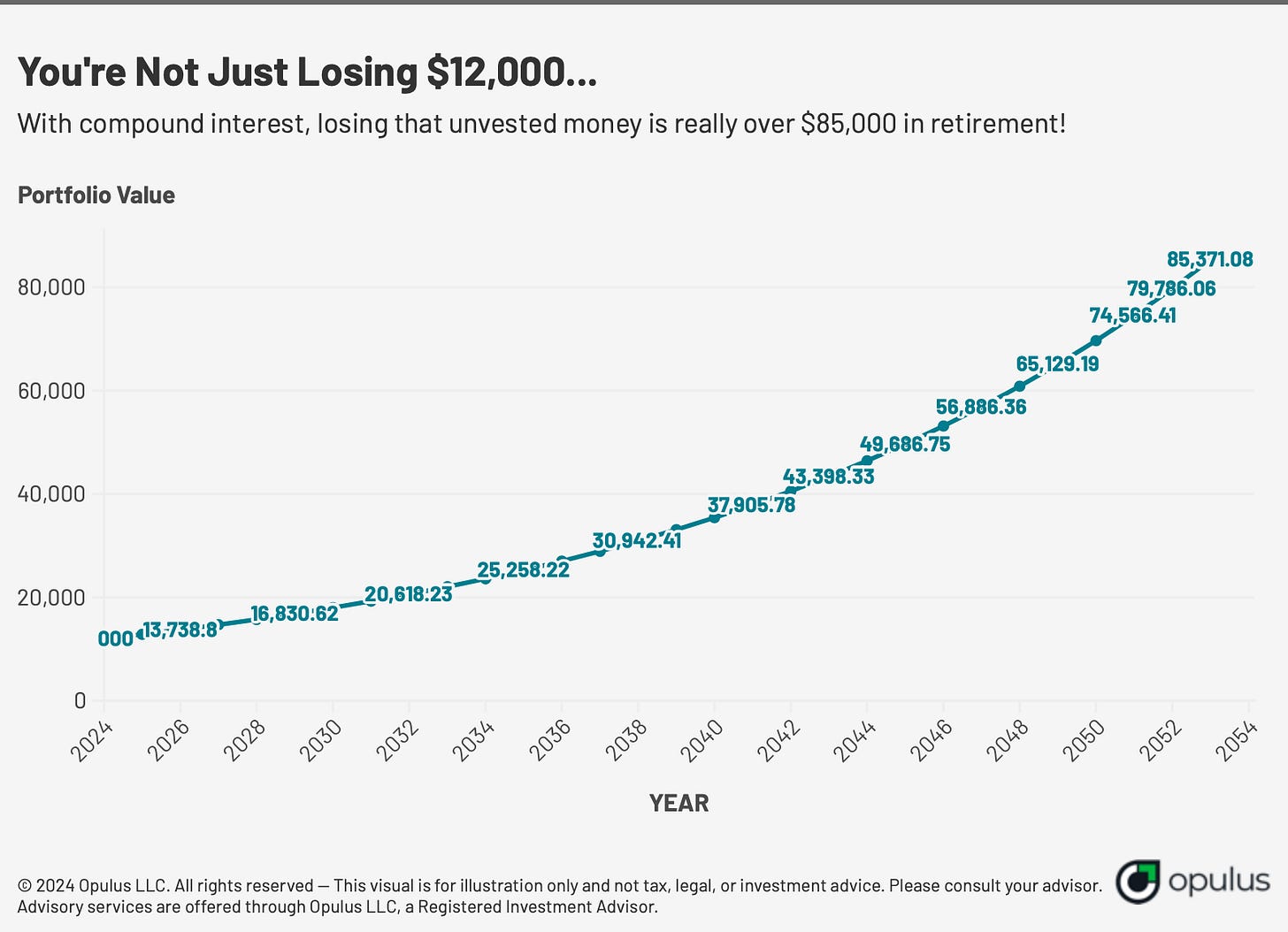

Leaving behind unvested employer match contributions doesn’t just affect your current savings—it has long-term consequences on your financial growth.

Here’s why:

Compounding Growth:

Every dollar you leave behind isn’t just lost—it’s money that could have grown tax-deferred for decades. For example, $12,000 left behind at age 35 could grow to over $85,000 by age 65, assuming a 7% annual return.Missed Opportunities:

Employer matches are essentially free money. By not staying vested, you’re not maximizing the benefits available to you, which could create a larger gap in your retirement savings plan.

Decisions about vesting are more than just immediate trade-offs—they’re decisions about your future financial freedom.

What Is a Vesting Schedule?

Employer matches in 401(k) plans aren’t always yours immediately. That’s where vesting schedules come in. They determine how much of the employer’s contributions you get to keep if you leave the company.

There are three common types:

Immediate Vesting: You keep 100% of the employer match from day one.

Cliff Vesting: You get 0% until a certain milestone (Ex: 2 years), then you’re 100% vested.

Graded Vesting: You gain partial ownership over time (Ex: 25% vested annually for 4 years).

Most high-paying jobs fall into the cliff or graded categories, meaning there’s a risk of leaving money behind if you leave too soon.

The “Golden Handcuffs” Effect

Vesting schedules are a classic example of what’s often called “golden handcuffs.”

This term refers to benefits—like employer matches, equity grants, or bonuses—that are designed to incentivize you to stay with your employer. These perks can be highly lucrative, but they can also make it hard to leave a job, even when better opportunities arise.

While these benefits are enticing, they can also keep you in a role longer than you intended—potentially at the cost of personal fulfillment, career growth, or better opportunities elsewhere.

The key? Know the true value of your golden handcuffs.

Practical Action Steps to Maximize Employer Benefits

To ensure you’re making the most of your employer benefits, take these steps today:

Review Your Vesting Schedule:

Log in to your 401(k) portal and check the Summary Plan Description (SPD) for details on your employer’s vesting rules.Ask HR About Vesting:

Use this exact question:

“What is the vesting schedule for employer match contributions? How much am I vested in today?”

Set Reminders for Milestones:

Track your vesting dates, bonus payouts, or RSU vesting timelines in your calendar to avoid missing out on significant benefits.Negotiate Lost Benefits:

If you’re leaving a job early and losing part of your match, try to negotiate a higher salary or sign-on bonus at your new employer to offset the cost.Leverage Other Benefits Before Leaving:

Max out health savings accounts, tuition reimbursement programs, or other perks before making your transition.

Why It Could Be Worth Waiting

For most six-figure earners, the employer match is a meaningful part of their retirement plan. Staying with your employer until you’re fully vested can mean tens of thousands of extra dollars in your 401(k).

Take a moment to calculate:

What’s your employer match today?

What’s your vesting timeline?

Even just one additional year could secure a significant amount.

However, sometimes it IS worth leaving - every situation is unique, and if you have a massive opportunity making significantly more money, maybe it is the right move to cut your losses!

But the key is awareness. Know exactly what you’re leaving behind so you can make an informed decision.

Conclusion

Understanding vesting schedules and the golden handcuffs tied to your role isn’t just about protecting your money—it’s about taking control of your financial future.

Every career decision comes with trade-offs, and sometimes the cost of leaving early is worth it for the right opportunity. But by knowing your vesting status and the true value of your benefits, you can make informed choices instead of costly mistakes.

The choices you make today shape the opportunities you have tomorrow. Start with one step: check your vesting schedule today. You’ll thank yourself later.

Thanks for reading. We’ll see you next week.

Whenever you're ready, there are 2 other ways we can help you:

Opulus Method Digital Course: Join 350+ students inside the Opulus Method. In just 90 minutes, learn a proven system to secure your financial freedom without sacrificing your lifestyle.

Join Opulus as a Client: We'll build your personalized strategy to reduce taxes, boost your income, and grow your wealth. Live life on your terms—we'll execute the financial strategy to get you there.

Opulus, LLC (“Opulus”) is a registered investment advisor in Pennsylvania and other jurisdictions where exempted. Registration as an investment advisor does not imply any specific level of skill or training.

The content of this newsletter is for informational purposes only and does not constitute financial, tax, legal, or accounting advice. It is not an offer or solicitation to buy or sell any securities or investments, nor does it endorse any specific company, security, or investment strategy. Readers should not rely on this content as the sole basis for any investment or financial decisions.

Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. There is no guarantee that any investment strategies discussed will result in profits or avoid losses.

All information is provided "as-is" without any warranties, express or implied. Opulus does not warrant the accuracy, completeness, or reliability of the information presented. Opinions expressed are those of the authors, Ryan Greiser and Francis Walsh, and are subject to change without notice.

Opulus is not responsible for any errors or omissions, nor for any direct, indirect, or consequential damages resulting from the use or reliance on this information. Use of the content is at your own risk. This content is not intended as an offer or solicitation in any jurisdiction where such an offer or solicitation would be illegal.