The 8 Money Rules Nobody Taught You

Earlier this year, a client earning $350,000 told me something that stopped me cold: "I'm doing everything 'right' with my money, but I'm not getting ahead."

I hate to break this to you, but most people were never taught how money actually works. We follow outdated advice designed for our parents' generation. We trust systems built to benefit institutions, not individuals.

But that doesn't mean we can't win.

After 12+ years of working with high-earners, I've discovered the wealthy don't follow traditional advice. They ignore Wall Street's wisdom and follow 8 unconventional rules that most financial advisors won't tell you about.

These are money rules that prioritize freedom over security, earning over saving, and ownership over debt. Rules that turn high income into lasting wealth and give you back control of your financial future.

In this newsletter, you'll discover:

Why static money is dying money (and what to do instead)

How to buy back your time with smart money moves

Why earning beats saving

The truth about job security (spoiler: it doesn't exist)

How debt becomes financial quicksand

The investment timeline that separates winners from losers

Why day trading destroys wealth

How to enjoy your money without guilt

Let's fix this once and for all.

Rule #1: Static Money Is Dying Money

Your savings account isn't safe—it's slowly going broke.

That $100,000 sitting in your "high-yield" checking account earning 0.25%? Inflation just stole ~$3,000 of its purchasing power this year. Over five years, you're looking at $15,000+ in lost buying power.

Here's what nobody tells you: Playing it "safe" creates guaranteed loss.

Your money needs to work harder than you do. Park it in assets that outpace inflation—index funds, real estate, even money market funds—or watch your financial future disappear one "safe" year at a time.

The wealthiest people I know follow a simple rule: keep enough to operate, invest the rest.

Rule #2: Buy Back Your Time

The ultimate luxury isn't a G Wagon—it's Tuesday afternoon freedom.

Every $1,000 you spend monthly on status symbols requires roughly $300,000 in investments to sustain forever. That same $1,000 invested in time-buying systems could free up 20+ hours weekly.

Think about it this way:

House cleaner: 4 hours back per week

Meal delivery: 6 hours back per week

Virtual assistant: 10+ hours back per week

Could you trade that designer purchase for an extra day of freedom each month? Most people buy things to impress others. Smart people buy time to live their own lives.

Freedom isn't what you own—it's what you don't need to do.

Rule #3: Earning Beats Saving

You can't budget your way to wealth.

Cutting that $5 daily coffee saves $1,825 per year. A 10% income increase for a $150,000 earner adds $15,000. The math isn't even close.

There's a limit to how much you can cut. There's no limit to how much you can earn.

Focus your energy on increasing your value, not obsessing over saving another $5.

Start a business

Learn new skills

Build side income

Negotiate your salary

The highest ROI financial skill isn't frugality—it's increasing what you're worth.

No budget in the world will make you wealthy. But income growth will.

Rule #4: Job Security Is a Myth

Companies are loyal to shareholders, not employees.

I watched a client lose his "secure" $250,000 job with zero warning after 15 years of loyalty—the company called it "restructuring," he called it betrayal.

But here's what separated him from his coworkers: he had an income stream he controlled.

Start small. Even 5-10% of your income from sources you own changes your entire financial psychology:

Freelance work

Rental property

Investment dividends

The best job security? Owning income streams where you're the boss.

Rule #5: Debt Is Financial Quicksand

Most debt keeps you working for someone else's dreams instead of your own.

The more things you finance, the more future income you've already spent. High-earners fall into this trap constantly—trading tomorrow's freedom for today's consumption.

Car payments

Credit card debt

Home equity lines

Each one creates a prison of monthly obligations.

The peace of mind from owning things outright is worth more than any points, miles, or temporary cash flow. When you own your stuff, your stuff doesn't own you.

Ownership isn't about possessions—it's about options.

Rule #6: Think in Half-Decades

The best financial moves look terrible in year one and brilliant in year five.

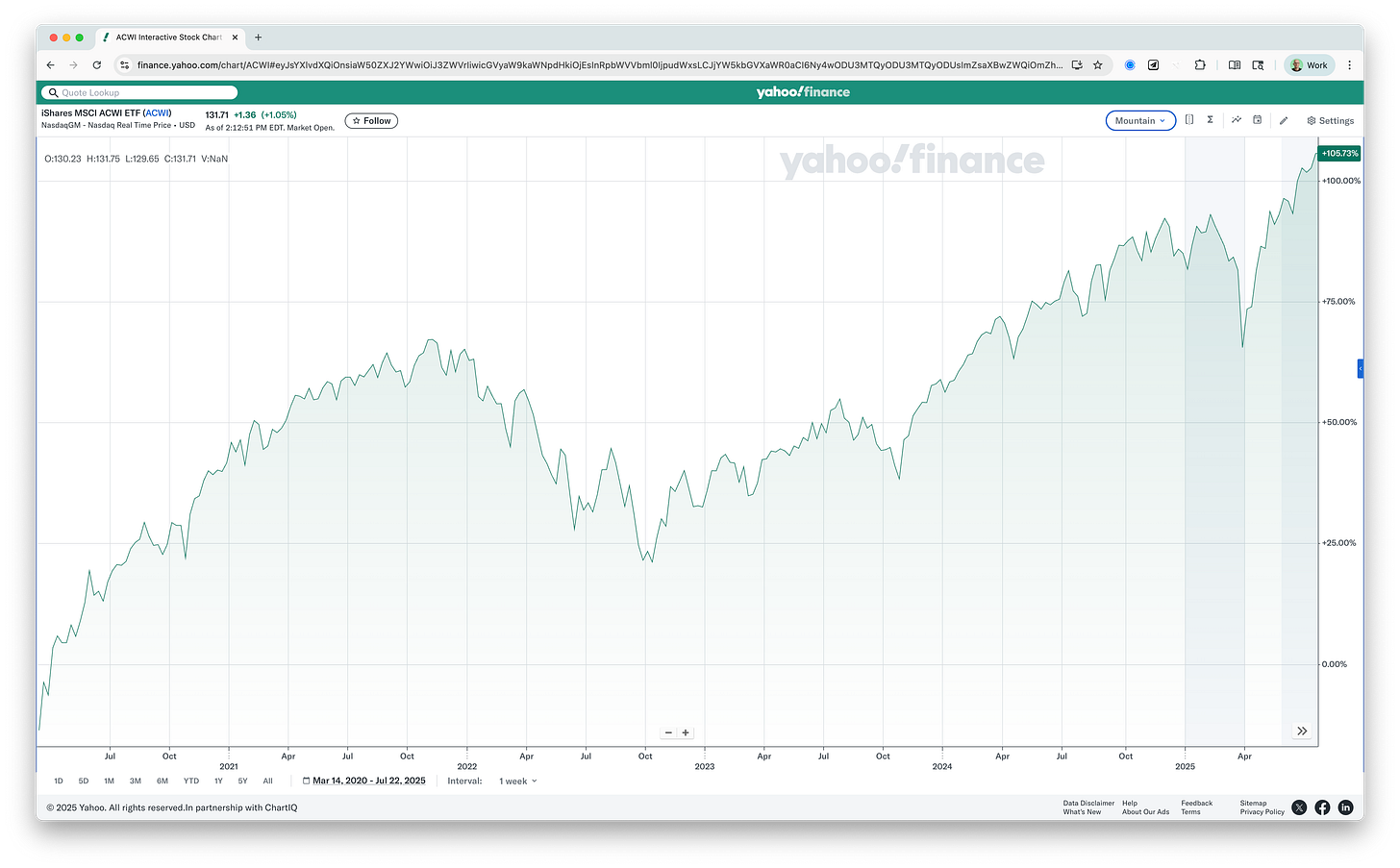

During the 2020 market crash, I watched investors panic-sell and miss an extraordinary recovery. Those who held tight didn't just recover—they captured a +105.78% gain from 03/14/2020 to 7/23/2025.

Your investment timeline should match your life timeline. Give your investments at least 5 years before judging their performance. The market rewards patience and punishes emotions.

Stop checking your portfolio daily. Start checking your net worth annually.

Rule #7: Avoid Day Trading

The market is smarter than you.

Studies show 97% of day traders lose money over 300 days. I've never seen a single client build sustainable wealth through day trading.

Zero. Ever.

Instead of gambling with your money, focus on consistent buying of quality assets. The boring strategy is usually the one that works.

The market is designed to transfer money from the impatient to the patient.

Rule #8: Money Is Meant to Be Enjoyed

Calculate your "freedom number"—then spend everything beyond it guilt-free.

I've watched people hoard 20X what they need while missing experiences they'll never get back. Their kids grew up. Their health declined. Their dreams expired.

Create memorable experiences.

Take the trip

Buy the guitar

Do cool things

Fund your passions

Invest in your relationships

What's the point of building wealth if you never use it?

That's it.

Remember that $350K client who was doing everything "right" but getting nowhere? He picked one rule and started there. Six months later, his relationship with money is changing.

These 8 rules have transformed how I look at money. They're not complex. They're not flashy. But they work when the system fails you.

The gap between high income and true wealth isn't knowledge—it's application. You now know what the wealthy know. The question is: will you do what they do?

Traditional financial advice keeps you safe and broke. These rules keep you growing and free.

The system wasn't built for you. But now you know how to beat it anyway.

Thanks for reading. See you next week.

Whenever you're ready, there are 2 other ways we can help you:

30-Day Strategy Sprint: Got a specific financial challenge holding you back? In just 30 days, we'll tackle 1-3 of your biggest money roadblocks and hand you a personalized action plan. Perfect if you want expert guidance without a long-term commitment. Limited spots available.

Ongoing Wealth Partnership: We'll work with you month after month to slash your taxes, find hidden income opportunities, and build lasting wealth. You set the life goals. We handle the financial strategy to get you there faster.

Opulus, LLC (“Opulus”) is a registered investment advisor in Pennsylvania and other jurisdictions where exempted. Registration as an investment advisor does not imply any specific level of skill or training.

The content of this newsletter is for informational purposes only and does not constitute financial, tax, legal, or accounting advice. It is not an offer or solicitation to buy or sell any securities or investments, nor does it endorse any specific company, security, or investment strategy. Readers should not rely on this content as the sole basis for any investment or financial decisions.

Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. There is no guarantee that any investment strategies discussed will result in profits or avoid losses.

All information is provided "as-is" without any warranties, express or implied. Opulus does not warrant the accuracy, completeness, or reliability of the information presented. Opinions expressed are those of the authors, Ryan Greiser and Francis Walsh, and are subject to change without notice.

Opulus is not responsible for any errors or omissions, nor for any direct, indirect, or consequential damages resulting from the use or reliance on this information. Use of the content is at your own risk. This content is not intended as an offer or solicitation in any jurisdiction where such an offer or solicitation would be illegal.