From 9.5% to 3.6%: How Brilliant People Sabotage Their Own Wealth

Here's a gut punch: You could be making six figures, have an MBA from Wharton, and still be “BAD” at investing.

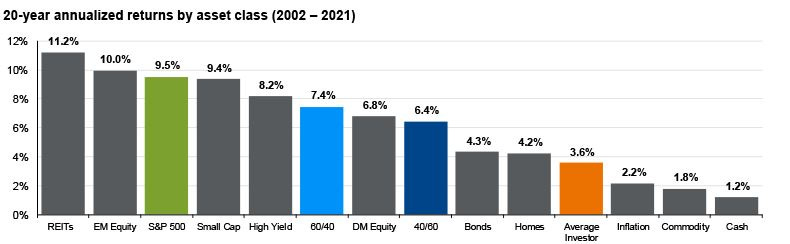

Don't believe me? JP Morgan tracked investor behavior from 2002-2021. The S&P 500 returned 9.5% per year. The average investor? Just 3.6%.

That's not a typo. That's not bad luck. That's self-sabotage disguised as "strategy."

Think about it: most people spend more time researching their next Netflix show than they do understanding why their portfolio underperforms year after year.

Here's the harsh reality: Your investment knowledge means nothing if your behavior destroys your returns.

In today's newsletter, I'll break down:

The 5 mistakes that separate the great investors from bad ones

Why your emotions cost more than any market crash

The "diversification" trap keeping you poor

How fee decisions make a big impact

Why trying to be "smart" makes you dumb

Let's dig in ↓

Mistake #1: Letting Your Feelings Run Your Portfolio (The Guaranteed Wealth Killer)

Your biggest enemy isn't the market. It's the mirror.

Every time you panic-sell during a crash or chase the hot stock everyone's talking about, you're handing your future self a massive bill.

Here's historical data that should terrify you: If you invested $10,000 in the S&P 500 from 2003-2023 but missed just the 10 best trading days, you might have ended up with ~$27,000 instead of ~$67,000.

Missing 10 days out of 7,300 could have cost $40,000 in this example.

The market doesn't care about your feelings. It rewards patience and punishes panic. Every. Single. Time.

Most people think they can predict when to get out and when to get back in. The data says otherwise. Even professional traders struggle with market timing.

Consider this approach: Set up systematic investing, avoid emotional decisions, and stop checking your portfolio during lunch breaks.

Mistake #2: "Diversification" That's Actually Just Expensive Confusion

More funds don't equal more protection.

I see investors with 25 mutual funds thinking they're diversified. In reality, they own the same 10 companies eight different ways and pay fees on all of them.

Morningstar research shows the average investor owns 8+ funds but ends up 90% correlated to the S&P 500 anyway.

That's like buying eight different flavors of vanilla ice cream and calling it variety.

Your "diversified" portfolio probably contains Apple, Microsoft, Google, and Nvidia wrapped in fancy fund names with high expense ratios.

Consider this approach: Three to five core funds might work for many investors. U.S. stocks, international stocks, bonds.

The key is understanding what you own and why you own it.

Mistake #3: Paying Fees Without Getting Value (The Silent Killer)

Here's the thing about fees: They're not inherently evil. But paying high fees for LOW VALUE? That's financial suicide.

The difference between a 0.85% actively managed fund and a 0.03% ETF might seem tiny. Over time, it's massive.

Here's an illustration that should keep you up at night:

Hypothetically investing $500/month for 30 years assuming 8% average annual returns:

Low-cost option: ~$745,000

High-fee option: ~$624,000

That's potentially $121,000 in fees over three decades.

But here's what most people miss: Some fees are worth paying.

If you're working with a fiduciary financial advisor who's doing comprehensive financial planning, tax strategy, estate planning, and behavioral coaching to keep you disciplined during market crashes - that fee might be the best money you ever spend.

The problem isn't fees. It's paying fees for products that don't add value beyond what you could get yourself.

The real question: What are you getting for those fees? If it's comprehensive planning and accountability that keeps you disciplined, it could be worth every penny.

Mistake #4: The "Set It and Forget It" Trap

Autopilot investing sounds smart until your risk tolerance gets hijacked.

Let's say you started with a sensible 70% stocks, 30% bonds portfolio in 2013. If you never rebalanced, by 2024 you might be sitting at 87% stocks, 13% bonds.

That's not the same risk profile you signed up for. That's a rocket ship with no parachute.

During 2008, that risk creep might have meant a 38% portfolio drop instead of 27% if you'd maintained your original allocation through regular rebalancing.

Your portfolio drifts. Your risk tolerance shouldn't.

Consider this approach: Annual rebalancing can help maintain your target risk profile. It takes 20 minutes and could potentially save you years of recovery time.

Mistake #5: Playing Chess While Everyone Else Plays Checkers (And Losing)

You want to know the definition of silliness? Thinking you can outsmart the market when 93% of professional fund managers couldn't beat the S&P 500 in 2022.

These are people with teams, algorithms, and access to information you'll never have. And they STILL struggled to outperform.

Yet somehow, plenty of folks think reading MarketWatch over coffee makes them Warren Buffett.

The market doesn't necessarily reward intelligence. It often rewards discipline. You don't need to predict the future. You need to show up consistently.

Historical data suggests that time in the market often beats timing the market - though past performance doesn't guarantee future results.

The Psychology Behind Why Smart People Make Dumb Money Moves

Most people treat investing like a video game where they need to "beat" something.

Earned returns feel precious because you researched and analyzed. Market returns feel "lucky" because you didn't work for them.

This psychological difference is why brilliant professionals often underperform simple index fund strategies.

The solution? Treat every investment decision the same, regardless of how clever it makes you feel.

Bottom Line: Strategy Beats Speculation Every Time

The secret to building wealth through investing isn't finding the next Tesla or perfectly timing market crashes.

It's systematically avoiding the mistakes that may:

Destroy long-term compound growth

Create unnecessary tax consequences

Generate high fees without corresponding value

Expose you to unintended risks

Here's the brutal truth: If you keep making these mistakes, you'll work until you're 65 and wonder where all your money went. If you avoid them and stay disciplined, you might retire wealthy while your "smart" friends are still trying to beat the market.

Your Strategic Action Plan

Building wealth often comes down to avoiding these five common mistakes:

Manage emotions - consider automating your investments

Understand your holdings - know what you own and why

Evaluate fees vs. value - understand what you're paying for

Review annually - consider setting a calendar reminder to review your portfolio

Stay consistent - market timing is not possible long term

The principles are straightforward. The execution requires discipline. The potential results could be life-changing.

The choice is yours. But compound interest won't wait for you to figure it out.

What will you choose? See you next week.

Whenever you're ready, there are 2 other ways we can help you:

30-Day Strategy Sprint: Got a specific financial challenge holding you back? In just 30 days, we'll tackle 1-3 of your biggest money roadblocks and hand you a personalized action plan. Perfect if you want expert guidance without a long-term commitment. Limited spots available.

Ongoing Wealth Partnership: We'll work with you month after month to slash your taxes, find hidden income opportunities, and build lasting wealth. You set the life goals. We handle the financial strategy to get you there faster.

Opulus, LLC (“Opulus”) is a registered investment advisor in Pennsylvania and other jurisdictions where exempted. Registration as an investment advisor does not imply any specific level of skill or training.

The content of this newsletter is for informational purposes only and does not constitute financial, tax, legal, or accounting advice. It is not an offer or solicitation to buy or sell any securities or investments, nor does it endorse any specific company, security, or investment strategy. Readers should not rely on this content as the sole basis for any investment or financial decisions.

Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. There is no guarantee that any investment strategies discussed will result in profits or avoid losses.

All information is provided "as-is" without any warranties, express or implied. Opulus does not warrant the accuracy, completeness, or reliability of the information presented. Opinions expressed are those of the authors, Ryan Greiser and Francis Walsh, and are subject to change without notice.

Opulus is not responsible for any errors or omissions, nor for any direct, indirect, or consequential damages resulting from the use or reliance on this information. Use of the content is at your own risk. This content is not intended as an offer or solicitation in any jurisdiction where such an offer or solicitation would be illegal.