The 1% Rule: A Simple Framework For Refinancing Your Loans As Rates Drop

And potentially save you more than $100k over the life of your loan.

In the world of personal finance, knowing when to make a move can be the difference between financial freedom and feeling stuck.

And right now? We're at a pivotal moment with interest rates.

If you took out a mortgage or loan since 2022, you're probably feeling trapped. The lenders? They're not exactly in a rush to set you free.

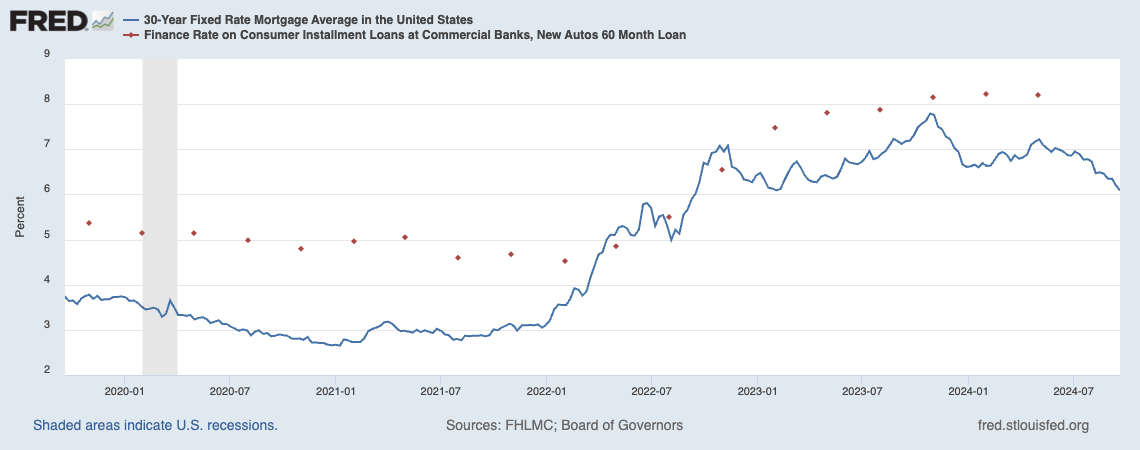

The average mortgage rate was in the 3% range for years before skyrocketing in 2022.

But here's the good news: rates are starting to drop.

And that means it's time to look at refinancing opportunities. But how do you know when it's worth it?

Enter the 1% Rule.

It's simple: if you can lower your interest rate by 1 percentage point or more, it's time to seriously consider a refinance. Think of it as your quick litmus test for potential savings.

Here's what we're going to break down today:

Why a Small Rate Drop Can Mean Big Savings

Applying the 1% Rule to Your Loan

Timing Your Refinance Move

Are Refinancing Costs Worth the Rate Cut?

The Other Key Numbers to Watch Before You Refinance

Why You Shouldn't Wait Too Long to Act

Let’s get into it.

1. Why a Small Rate Drop Can Mean Big Savings

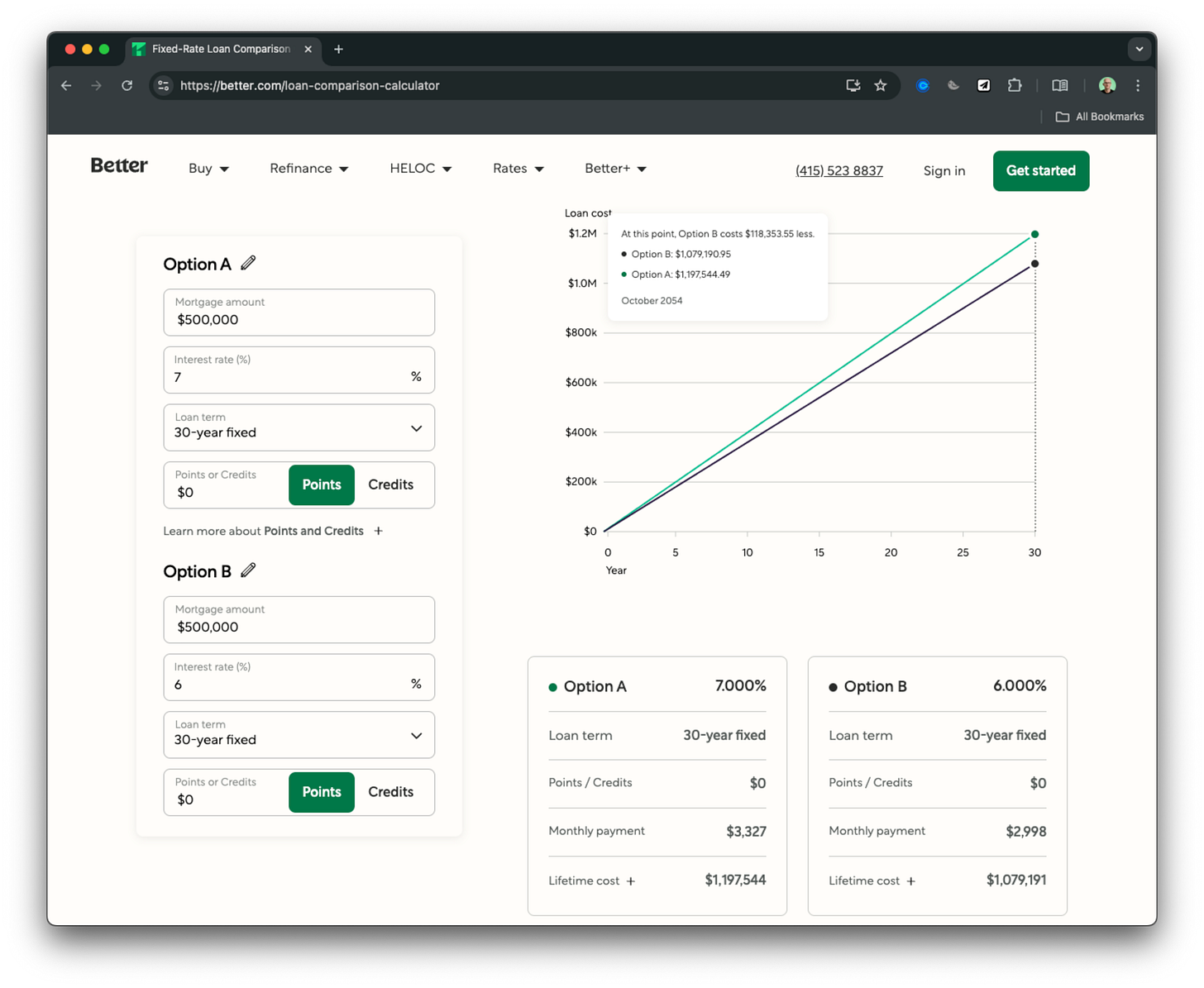

A 1% drop in your interest rate might not sound like much. But don't be fooled – it can significantly impact your finances. Here's a real-world example:

On a $500,000 30-year mortgage:

At 7%: Your monthly payment is $3,327

At 6%: Your monthly payment drops to $2,998

That's a difference of $329 per month or $3,948 per year. Over 30 years, you'd save $118,353 in interest alone.

This isn't just about numbers on a page. It's real money that could go towards your financial goals, whether that's boosting your savings, funding your children's education, or improving your quality of life.

But here's an important point: You don't always need to wait for a full 1% drop to benefit. Sometimes, even a 0.5% reduction can make refinancing worthwhile, especially if you plan to stay in your home long-term.

The key is to run the numbers for your specific situation. What works for one person might not work for another. It's about making the best decision for your unique financial picture.

2. Applying the 1% Rule to Your Loan

Not all loans are created equal. Here's how to quickly evaluate if the 1% rule makes sense for you:

Check your current rate: Pull out your loan documents or log into your account.

Compare to current market rates: Websites like Bankrate.com and NerdWallet.com offer average rates based on loan types.

Calculate potential savings: Use an online refinance calculator to crunch the numbers.

Consider your timeline: How long do you plan to keep the loan? Longer terms mean more potential savings.

Remember, the 1% rule is a guideline, not a hard-and-fast rule. Sometimes, refinancing makes sense even with a smaller rate drop. It all depends on your specific financial picture.

Pro Tip: Don't fall for the trap of extending your payoff timeline. If you're 2 years into a 30-year mortgage, refinancing to another 30-year term means 32 years of payments. Instead, consider a 28-year term. You'll keep your original payoff date while potentially lowering your rate. It's a small action that can lead to big outcomes.

3. Timing Your Refinance Move

Timing the market perfectly is impossible. But that doesn't mean you can't make a smart move.

Here's what to watch:

Federal Reserve decisions: These can signal where rates are heading.

Economic indicators: Things like inflation rates and job reports can influence lending rates.

Your personal financial changes: A boost in credit score or income can qualify you for better rates.

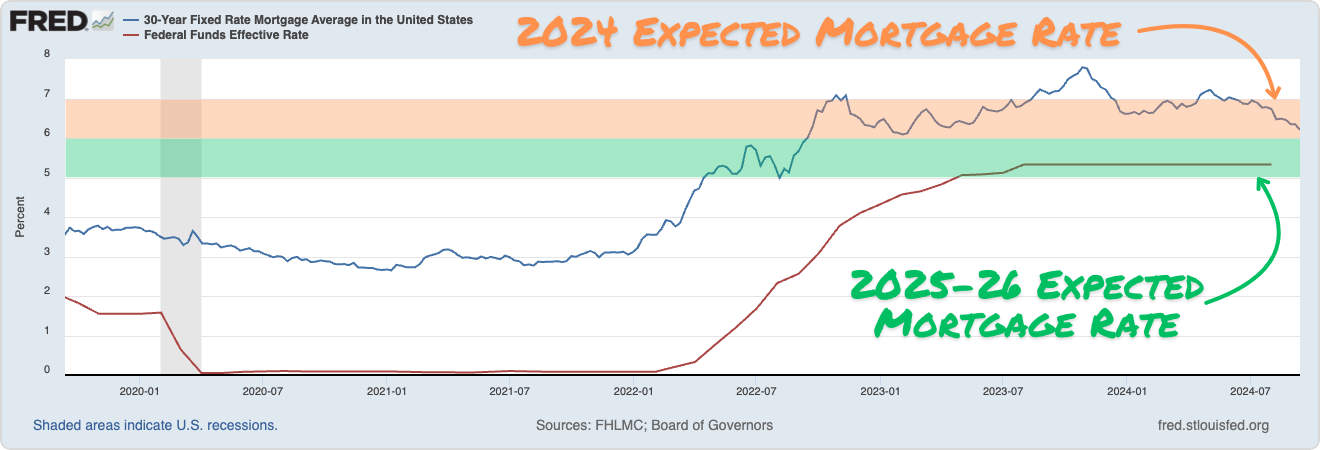

Looking ahead, experts project the following based on the Federal Reserve Rate targets:

Short-Term (2024): Mortgage rates may hover between 6% to 7%.

Medium-Term (2025-2026): Rates could shift to the 5% to 6% range.

Long-Term (2027 and beyond): We might see rates around 4.5% to 5.5%.

While we're unlikely to see a return to the ultra-low rates of 2-3% from the pandemic era, rates in the 4-5% range may become more common if the Fed's plans unfold as projected.

But here's the thing: Waiting for the "perfect" moment can cost you. If rates drop and you qualify for a better loan, don't let perfect be the enemy of good. Taking action now could save you thousands while others are still on the fence.

4. Are Refinancing Costs Worth the Rate Cut?

Refinancing isn't typically free. But don't let that scare you off – often, the long-term savings far outweigh the upfront costs.

Here's what to consider:

Closing costs:

Mortgage & Home Equity: 2% to 5% of the loan.

Student Loans: Usually $0.

Personal Loans & Credit Card Refinancing: 1% to 5%.

Business Loans: 1% to 3%.

Auto Loans: $0 to $100.

Break-even point: How long will it take for your monthly savings to cover the refinancing costs?

Long-term savings: Look beyond the break-even point to see your total potential savings.

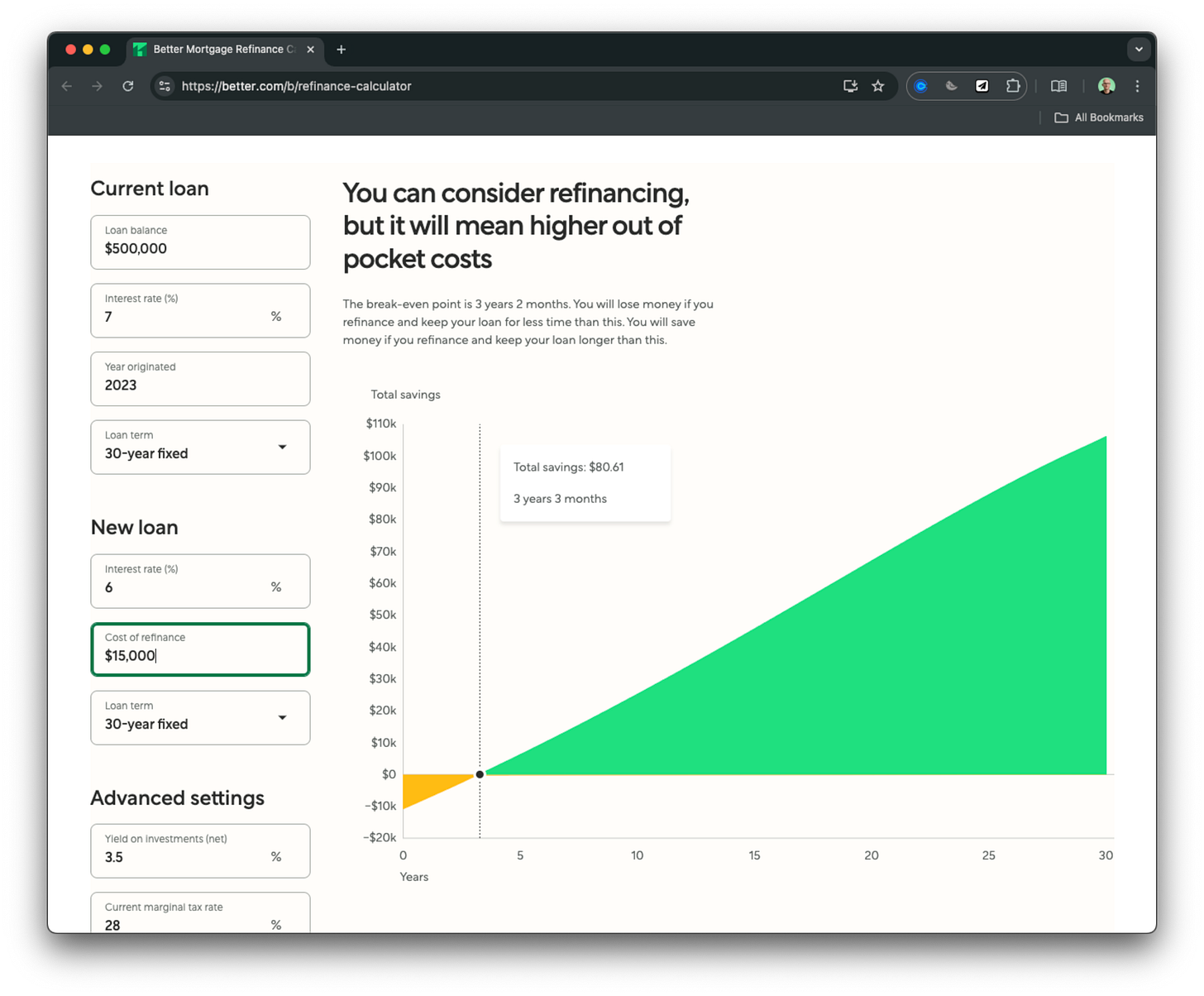

Pro Tip: Use the Better Mortgage Refinance Calculator to quickly assess your potential savings. Here's what it might tell you:

For our $500,000 example dropping from 7% to 6%:

“You can consider refinancing, but it will mean higher out of pocket costs. The break-even point is 3 years 2 months. You will lose money if you refinance and keep your loan for less time than this. You will save money if you refinance and keep your loan longer than this.”

5. The Other Key Numbers to Watch Before You Refinance

Interest rates grab headlines, but they're not the only numbers that matter. Here's what else to keep an eye on:

Your credit score: A higher score can qualify you for better rates. Take steps to boost it before applying.

Loan-to-value ratio: If your home's value has increased, you might qualify for better terms.

Debt-to-income ratio: Paying down other debts can improve your chances of approval and potentially snag you a lower rate.

Prepayment penalties: Check if your current loan has any – these could eat into your refinancing savings.

Remember, lenders look at your entire financial picture. Strengthening these areas can put you in a prime position to capitalize when rates drop.

6. Why You Shouldn't Wait Too Long to Act

The market waits for no one. Rates can change quickly, and opportunities can vanish in the blink of an eye.

Consider this:

Rate locks are typically good for 30-60 days. If you see a rate you like, lock it in.

The refinancing process can take 30-45 days. Starting early gives you a buffer.

As rates drop, lenders get busier, potentially slowing down the process.

But don't let this push you into a hasty decision.

The goal is to be prepared, not panicked. Stay informed, keep your financial house in order, and be ready to move when the time is right.

That's it.

Remember, refinancing isn't just about getting a lower rate – it's about creating a financial strategy that works for you. It's about building wealth, brick by brick, and setting yourself up for long-term success.

The market will always fluctuate, but your financial goals don't have to. Stay focused, stay informed, and don't be afraid to take action when the numbers make sense.

Thanks for reading. I’ll see you next week.

Whenever you're ready, there are 2 other ways we can help you:

Opulus Method Digital Course: Join 350+ students inside the Opulus Method. In just 90 minutes, learn a proven system to secure your financial freedom without sacrificing your lifestyle.

Join Opulus as a Client: We'll join forces to create a personal financial plan and investment strategy to secure your financial future. Let us handle the complex details. Go ahead and enjoy your life.

Opulus, LLC (“Opulus”) is a registered investment advisor in Pennsylvania and other jurisdictions where exempted. Registration as an investment advisor does not imply any specific level of skill or training.

The content of this newsletter is for informational purposes only and does not constitute financial, tax, legal, or accounting advice. It is not an offer or solicitation to buy or sell any securities or investments, nor does it endorse any specific company, security, or investment strategy. Readers should not rely on this content as the sole basis for any investment or financial decisions.

Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. There is no guarantee that any investment strategies discussed will result in profits or avoid losses.

All information is provided "as-is" without any warranties, express or implied. Opulus does not warrant the accuracy, completeness, or reliability of the information presented. Opinions expressed are those of the authors, Ryan Greiser and Francis Walsh, and are subject to change without notice.

Opulus is not responsible for any errors or omissions, nor for any direct, indirect, or consequential damages resulting from the use or reliance on this information. Use of the content is at your own risk. This content is not intended as an offer or solicitation in any jurisdiction where such an offer or solicitation would be illegal.