How Whole Life Insurance Silently Undermines Your Wealth

Plus the exact question that makes insurance agents sweat.

"Whole life insurance is a great way to build wealth."

This line gets pitched to high-income millennials constantly. But is it true?

Today we’re going to look beyond the marketing claims and examine the actual numbers.

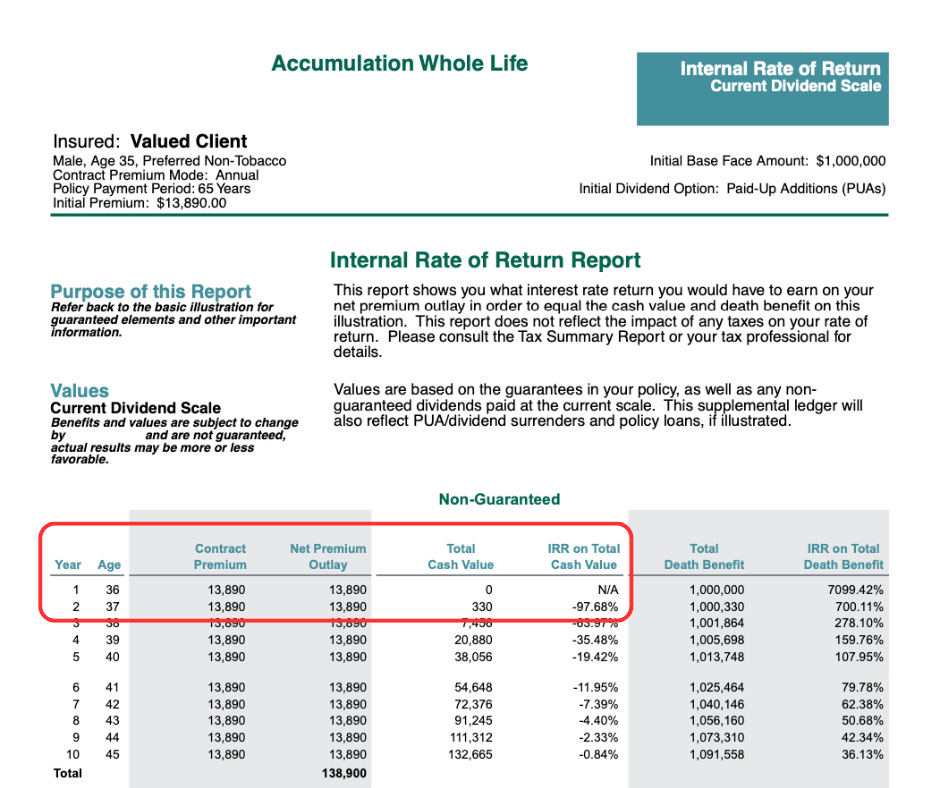

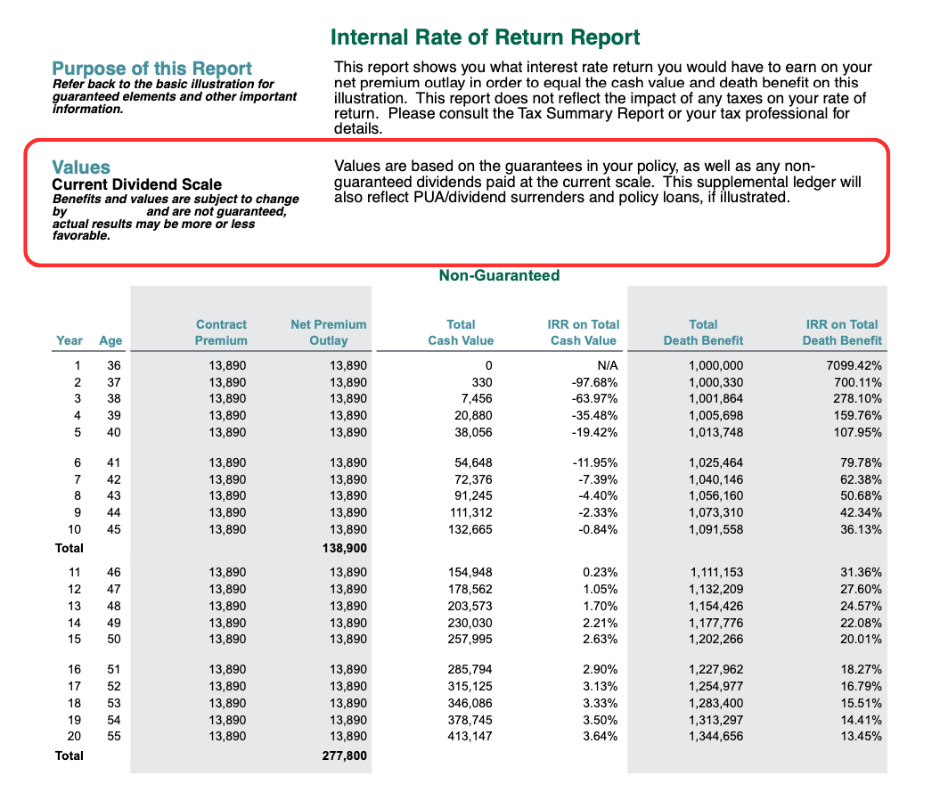

I asked an insurance agent to run me a whole life illustration for a $1M policy (35-year-old male, non-tobacco). Premium: $13,890/year.

I found what I was looking for on page 26—the part of the illustration that never makes it into the sales conversation:

The illustration shows an internal rate of return (IRR) on your cash in year two of -97.68%

That's not a typo. In the early years, your "wealth-building vehicle" loses almost everything you put in.

In this newsletter, you'll discover:

What happens to your money in the first decade

The long-term returns you can actually expect

Why these policies get recommended despite the numbers

Smarter alternatives for building real wealth

Let's look at what the illustration really shows.

The First Decade: Not Exactly "Wealth Building"

For a product marketed as a wealth-building tool, the early performance is surprising.

You have $330 in cash value for the first two years. You've paid $27,780 in premiums and have nothing to show for it in terms of accessible cash.

Your money isn't building wealth — it's locked away.

Can't access it

Can't use it as collateral

Can't leverage it for opportunities

Meanwhile, your agent receives their commission up front.

The pattern continues throughout the first decade.

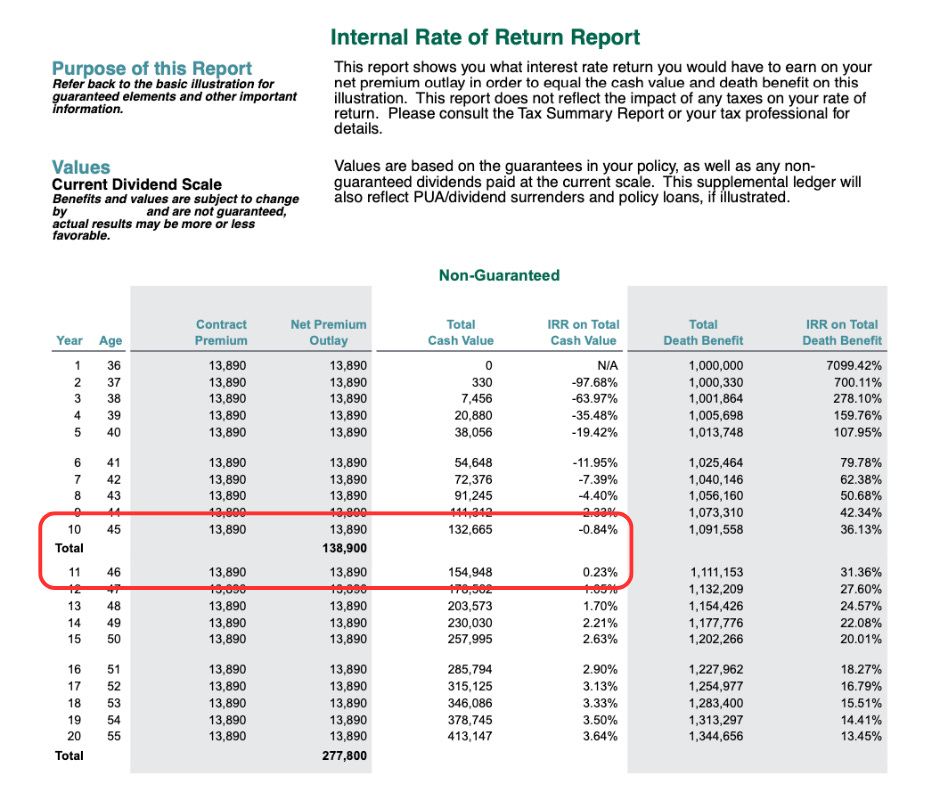

The policy delivers negative returns for TEN STRAIGHT YEARS. You only break even with a modest 0.23% return in year 11.

After a decade and $138,900 in premiums, your "wealth-building vehicle" has barely returned your principal. Would you accept this timeline and performance from any other investment?

Absolutely not.

But maybe the long-term results make up for the slow start...

The Long-Term Results: Underwhelming Wealth Creation

Even when the returns finally turn positive, they're modest compared to alternatives.

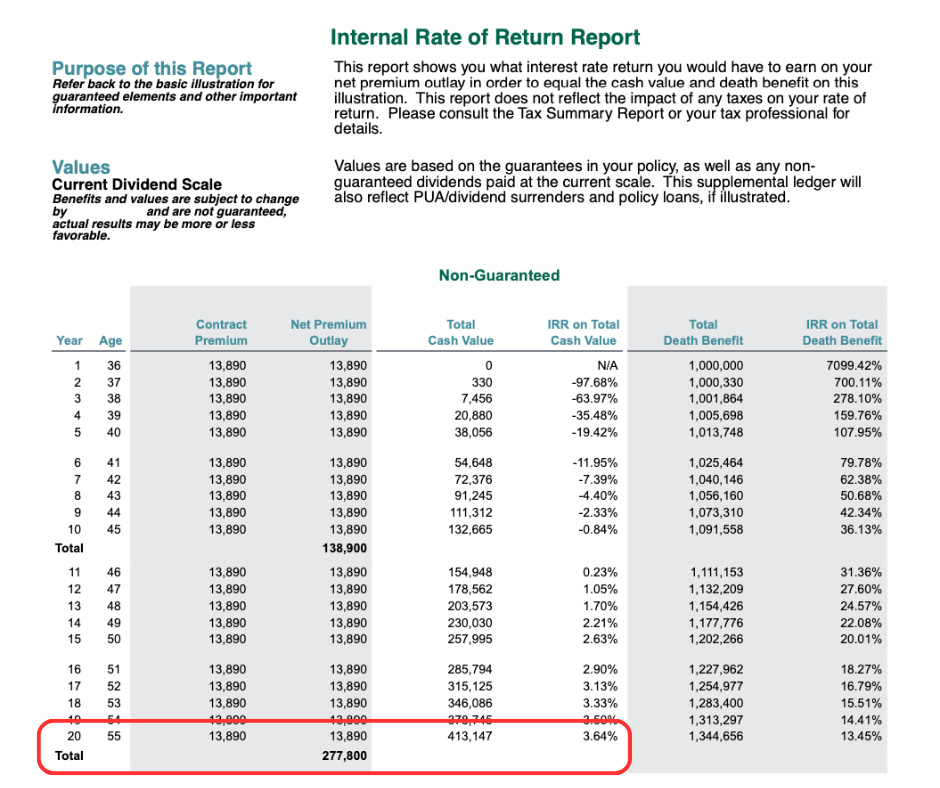

After 20 years and $277,800 in premiums, your “non-guaranteed” return is 3.64%.

For context, a basic S&P 500 index fund historically delivers around 8%. That's $413,000 (whole life) vs. $641,000 (index fund).

The difference? A 55% better historic return with a simpler, more liquid investment strategy.

And here's something worth noting — even that 3.64% isn't guaranteed.

The illustration includes this disclaimer that's easy to miss:

"Benefits and values are subject to change and are not guaranteed, actual results may be more or less favorable."

"Less favorable" is the key phrase here.

When they say "non-guaranteed," they mean exactly that. Companies adjust dividend rates based on their performance, not yours.

Those projected returns? They could be lower than illustrated.

Why These Policies Get Recommended Despite the Numbers

When the wealth-building numbers don't look compelling, agents emphasize other benefits.

That's when you'll hear phrases like:

"Become your own bank!" (Though policy loans reduce your death benefit and can have interest charges)

"Tax-free income!" (That comes after years of below-market returns)

"Legacy planning!" (Which could be addressed through other methods)

These features sound attractive. But compare the 3.64% return to the market's historical 8%.

The financial industry tends to benefit from complexity. The more complicated a product, the harder it is to compare true costs and benefits.

The commission structure is worth understanding: Agents typically earn 50-110% of your first-year premium. On a $13,890 policy, that's $6,945 to $15,279. This creates a strong incentive to recommend these products.

Meanwhile, more straightforward wealth-building approaches often deliver better performance with greater flexibility.

When Does Whole Life Make Sense as a Financial Tool?

Whole life insurance does have legitimate uses — just not primarily for wealth building for most millennials.

There are three scenarios where it serves specific purposes well:

Estate planning for ultra-high net worth individuals with estate tax concerns (typically $13M+ net worth)

Special needs planning for lifetime care

Business succession or key person coverage

For most high-income millennials focused on building wealth, there are more efficient vehicles.

What strategies tend to work better for wealth creation?

Buy term insurance for protection at a lower cost

Invest the premium difference in low-cost index funds

Max out tax-advantaged accounts like 401(k)s, Roth IRAs, and HSAs first

Use a taxable brokerage account for additional investments

This straightforward approach typically creates significantly more wealth over time while maintaining flexibility along the way.

That's it.

Financial products often become complex, making it harder to see the true performance beneath the marketing.

Now you've seen what the illustration actually shows on page 26.

When someone suggests whole life insurance as a wealth-building strategy, ask them directly: "Can you show me the internal rate of return for each year on the illustration?" Watch their reaction closely.

Remember: A wealth-building vehicle that takes 10 years just to break even deserves careful scrutiny.

Trust the numbers, not the narrative.

See you next Tuesday,

Whenever you're ready, there are 2 other ways we can help you:

30-Day Strategy Sprint: Got a specific financial challenge holding you back? In just 30 days, we'll tackle 1-3 of your biggest money roadblocks and hand you a personalized action plan. Perfect if you want expert guidance without a long-term commitment. Limited spots available.

Ongoing Wealth Partnership: We'll work with you month after month to slash your taxes, find hidden income opportunities, and build lasting wealth. You set the life goals. We handle the financial strategy to get you there faster.

Opulus, LLC (“Opulus”) is a registered investment advisor in Pennsylvania and other jurisdictions where exempted. Registration as an investment advisor does not imply any specific level of skill or training.

The content of this newsletter is for informational purposes only and does not constitute financial, tax, legal, or accounting advice. It is not an offer or solicitation to buy or sell any securities or investments, nor does it endorse any specific company, security, or investment strategy. Readers should not rely on this content as the sole basis for any investment or financial decisions.

Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. There is no guarantee that any investment strategies discussed will result in profits or avoid losses.

All information is provided "as-is" without any warranties, express or implied. Opulus does not warrant the accuracy, completeness, or reliability of the information presented. Opinions expressed are those of the authors, Ryan Greiser and Francis Walsh, and are subject to change without notice.

Opulus is not responsible for any errors or omissions, nor for any direct, indirect, or consequential damages resulting from the use or reliance on this information. Use of the content is at your own risk. This content is not intended as an offer or solicitation in any jurisdiction where such an offer or solicitation would be illegal.