Fear, Greed, and Scarcity: The Hidden Wealth Destroyers

Mastering your emotions around finances isn’t as complex as you might think. It requires awareness and discipline, but the payoff is enormous.

Let's get real for a moment. Your financial struggles aren't just about market conditions – they're about the decisions you're making. And those decisions? They're being manipulated by fear, greed, and a scarcity mindset.

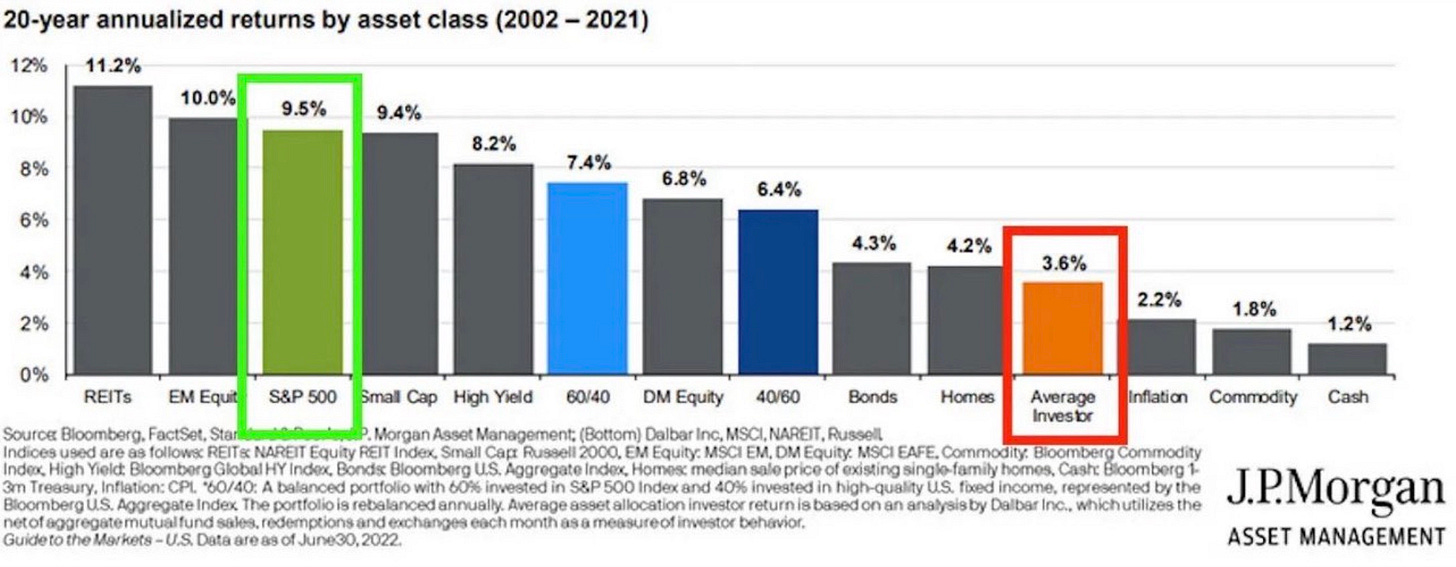

Here’s the truth: According to a study by Dalbar, the average investor underperforms the market by nearly 3.96% annually due to poorly timed emotional decisions like panic selling and chasing returns. This underperformance can significantly erode long-term wealth accumulation.

This chart below from J.P Morgan shows an even bigger discrepancy from the Dalbar study!

We’re all in a constant battle with our instincts when it comes to money management. The good news? Mastering your emotions around finances isn’t as complex as you might think. It requires awareness and discipline, but the payoff is enormous.

I’m about to share a straightforward three-step process that could save you thousands. It won’t cost you anything but attention and commitment. Let’s dive in.

A No-Nonsense Guide to Emotionally Intelligent Investing

Step 1: Identify Your Emotional Triggers

First, you need to catch yourself in the act. When you feel the urge to panic sell or go all-in on the latest investment craze, pause. Ask yourself: “Is this a rational decision, or am I letting emotions take the wheel?”

Pro tip: Start tracking your reactions to market news. Studies show that during bear markets, 66% of investors feel anxious, and over HALF are likely to sell, according to a report from Bank of America. Tracking your emotions will help you understand your patterns and improve future decision-making.

Step 2: Develop and Commit to a Long-Term Plan

Write down your financial goals, risk tolerance, and strategy. Here’s the crucial part – stick to it. Don’t overhaul your entire approach every time the market hiccups. Trust your plan, especially during volatile times.

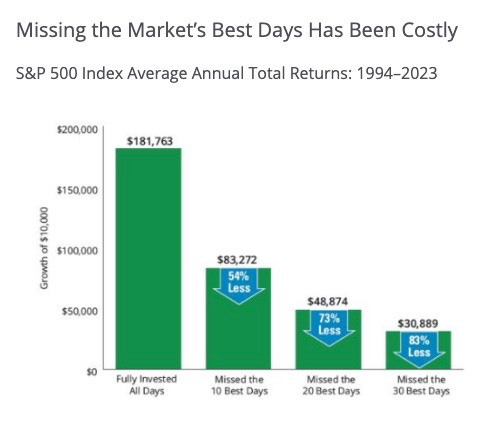

Did you know that missing just the 10 best trading days over a 20-year period can reduce your total returns by nearly 50%? That’s why staying invested, even during downturns, is essential.

Step 3: Leverage Automation

Remove emotions from daily money management by automating key financial decisions. Set up automatic transfers for savings, investments, and debt payments. As Warren Buffett advises on index funds: "Set it and forget it." There’s wisdom in simplicity. Automation takes out the human error aspect. We’re all busy, stuff always comes up, and we’re bound to mess up. Let’s avoid that completely

63% of Americans report struggling with consistent savings. Automating your finances ensures that emotions like greed or fear don’t interfere with your savings or investment goals.

The Psychology Behind This Approach

Self-awareness as a Financial Tool: Recognizing your emotional triggers creates space for rational decision-making. It’s about pausing before you act on impulse. The average investor’s biggest enemy isn’t the market—it’s their own reactions, as the annualized 3.96% performance gap shows.

Your Plan as a Financial Guide: A solid plan keeps you oriented during market turbulence. A study from Vanguard found that people who stayed invested during 2020’s COVID-19 market drop had returns that were nearly 50% higher than those who sold at the bottom.

Automation Trumps Willpower: By automating your finances, you’re safeguarding against emotional interference. A 2019 Fidelity study found that people who automated their investments were 30% more likely to reach their retirement goals than those who didn’t.

The Bottom Line

Market fluctuations are inevitable. Your response to them isn’t. By mastering your emotions, adhering to a well-thought-out plan, and leveraging automation, you’ll position yourself miles ahead of investors who let their feelings dictate their financial decisions.

Remember: The most significant threat to your wealth isn’t external—it’s internal. It’s the emotional reactions that lead to poor choices. Armed with this knowledge and these strategies, you’re now equipped to make smarter, more disciplined financial decisions.

Take control of your financial future. It starts with mastering your mind. Control the things we can control, and let time work on our side.

Have a great week everyone!

See you next week,

Whenever you're ready, there are 2 other ways we can help you:

Opulus Method Digital Course: Join 350+ students inside the Opulus Method. In just 90 minutes, learn a proven system to secure your financial freedom without sacrificing your lifestyle.

Join Opulus as a Client: We'll join forces to create a personal financial plan and investment strategy to secure your financial future. Let us handle the complex details. Go ahead and enjoy your life.

Opulus, LLC (“Opulus”) is a registered investment advisor in Pennsylvania and other jurisdictions where exempted. Registration as an investment advisor does not imply any specific level of skill or training.

The content of this newsletter is for informational purposes only and does not constitute financial, tax, legal, or accounting advice. It is not an offer or solicitation to buy or sell any securities or investments, nor does it endorse any specific company, security, or investment strategy. Readers should not rely on this content as the sole basis for any investment or financial decisions.

Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. There is no guarantee that any investment strategies discussed will result in profits or avoid losses.

All information is provided "as-is" without any warranties, express or implied. Opulus does not warrant the accuracy, completeness, or reliability of the information presented. Opinions expressed are those of the authors, Ryan Greiser and Francis Walsh, and are subject to change without notice.

Opulus is not responsible for any errors or omissions, nor for any direct, indirect, or consequential damages resulting from the use or reliance on this information. Use of the content is at your own risk. This content is not intended as an offer or solicitation in any jurisdiction where such an offer or solicitation would be illegal.