3 Legal Ways to Reposition Your Child's UTMA Before Age 21

How to restructure custodial accounts when you're worried about readiness—without breaching fiduciary duty.

A client called me last week. Her voice had that tight, controlled panic you hear when someone just realized a problem that’s ten years away but feels urgent today.

“My in-laws set up a UTMA for my son. It’s at $75K now. He gets it all at 21… that’s in ten years. There’s no way he’ll be ready.”

Here’s what most parents don’t know: You’re not stuck with a decision made a decade ago. You have legal ways to reposition that money. But the options narrow the closer you get.

Why this creates a problem

Most 21-year-olds aren’t ready to manage $75K responsibly.

Not because they’re irresponsible. Because they’ve never had to make high-stakes financial decisions under real pressure.

First job. First apartment. First taste of real money.

That’s a recipe for expensive mistakes.

UTMA stands for Uniform Transfers to Minors Act—a custodial account that lets you transfer assets to a minor without setting up a formal trust. The adult (you or the grandparent who opened it) manages the money until the child reaches the “age of termination.”

Then it all transfers to them.

And here’s the legal reality: You can’t just hold onto the money.

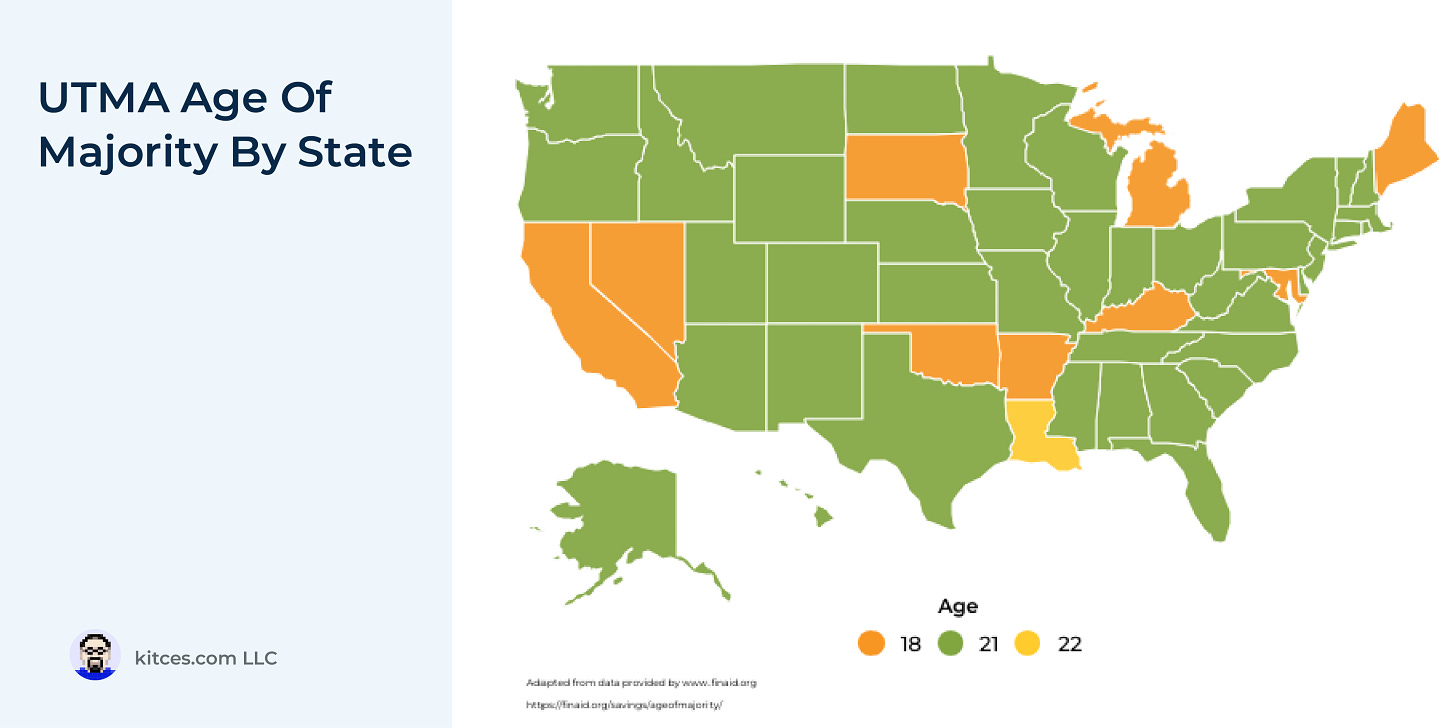

The moment your child hits the termination age—18 or 21, depending on your state—the account must transfer. No conditions, no oversight, no “let me hold this for you.”

Withholding it? That’s breach of fiduciary duty.

Your window to act? Right now.

Estate planning attorney David Haughton recently published a comprehensive breakdown of these strategies at Kitces.com. Here’s what I’ve learned working through them with my clients.

Strategy #1: Spend it down strategically

Use the UTMA money on things that enrich your child’s life—but aren’t your legal obligation to provide.

Qualifying expenses:

Summer camps

A car

Tutoring

Travel experiences

Sports equipment

Not qualifying (these are support obligations):

Food

Housing

Basic clothing

Here’s the smart repositioning move:

Spend the UTMA money on qualifying expenses. Then take the cash you would’ve spent out of pocket—and move it into an account YOU control: a 529, a brokerage account, whatever works for you.

You’ve given your child the benefit of that money. But you’ve kept control of equivalent funds.

Works best when: Your balance is under $50K and you have 3-5+ years until termination.

One caution: If you liquidate investments to spend down, watch the kiddie tax. Your child’s unearned income over $2,700 gets taxed at YOUR rate—not theirs. Small balances? Probably fine. Big gains? Talk to your CPA first.

This strategy buys you time. It doesn’t eliminate the problem—but it reduces the dollar amount that transfers when your child hits 21.

Strategy #2: Transfer to a UTMA 529

Same termination age. But now there’s friction.

You move the UTMA assets into a UTMA 529 plan. Your child still gets control at 18 or 21—but non-education withdrawals trigger taxes plus a 10% penalty on earnings.

Most kids won’t blow their college fund on a Tesla.

How to execute:

Liquidate the UTMA (529s only accept cash)

Open a UTMA 529 in your child’s name

Transfer the proceeds

The constraint: You cannot change the beneficiary. This money is still locked to your child—just with guardrails around non-education use.

Ideal for: $30K–$100K balances and college-bound kids.

Bonus move: Unused 529 funds can now roll into a Roth IRA—up to $35K lifetime limit. That’s a tax-free retirement account, funded early, for your kid.

Same caution: If you’re liquidating big gains (over $2,700 in unearned income), you’ll trigger kiddie tax at your rate. Run the numbers first.

This strategy doesn’t delay access—but it makes reckless withdrawals expensive enough that most kids won’t do it.

Strategy #3: Convert to a 2503(c) trust

Most protective. Most complex.

Here’s how it works: At termination age, your child gets a 30–60 day window to withdraw everything. If they don’t exercise that right? The money stays in trust until the age you specify—25, 30, even later.

You must notify your child of their withdrawal rights. That’s the law.

But here’s what happens in practice: Most kids won’t pull the trigger if they trust your judgment and the money’s been managed well.

It’s not about control. It’s about maturity.

Requirements:

Estate attorney (yes, legal fees)

Start the process an attorney at least 1–2 years before your child hits termination age

Why the timeline matters: The legal work takes time, and the closer you get to termination, the less runway you have to make the fees worth it. If your child turns 21 in six months, you’re probably too late.

Consider this when: Your balance exceeds $100K or you have serious readiness concerns.

This isn’t about withholding money from your child. It’s about matching money to maturity.

If your child needs the funds at 21—for a business, a home down payment, legitimate expenses—they can take them. But if they’re not ready? The trust keeps it safe until they are.

This strategy gives your child a choice at 21. But it doesn’t force them to take money they’re not ready to manage.

That’s it.

The UTMA panic my client felt wasn’t really about the money.

It was about feeling trapped by a decision someone else made years ago—before she knew what her son would need, before she understood the stakes, before the account had grown to $75K.

But here’s the truth: You’re not trapped.

You have legal options. Time is still on your side—if you act now. And you have a chance to set your child up for long-term success, not just a short-term windfall.

This isn’t about control. It’s about readiness.

Check your state’s termination age today. Not next year. Then talk to an estate attorney or financial advisor before that deadline gets close.

The best gift you can give your child isn’t the money. It’s making sure they’re ready for it when it arrives.

Thanks for reading. See you next week.

— Ryan

Whenever you’re ready, there are 2 other ways we can help you:

30-Day Strategy Sprint: Got a specific financial challenge holding you back? In just 30 days, we’ll tackle 1-3 of your biggest money roadblocks and hand you a personalized action plan. Perfect if you want expert guidance without a long-term commitment. Limited spots available.

Ongoing Wealth Partnership: We’ll work with you month after month to slash your taxes, find hidden income opportunities, and build lasting wealth. You set the life goals. We handle the financial strategy to get you there faster.

Opulus, LLC (“Opulus”) is a registered investment advisor in Pennsylvania and other jurisdictions where exempted. Registration as an investment advisor does not imply any specific level of skill or training.

The content of this newsletter is for informational purposes only and does not constitute financial, tax, legal, or accounting advice. It is not an offer or solicitation to buy or sell any securities or investments, nor does it endorse any specific company, security, or investment strategy. Readers should not rely on this content as the sole basis for any investment or financial decisions.

Past performance is not indicative of future results. Investing involves risks, including the potential loss of principal. There is no guarantee that any investment strategies discussed will result in profits or avoid losses.

All information is provided “as-is” without any warranties, express or implied. Opulus does not warrant the accuracy, completeness, or reliability of the information presented. Opinions expressed are those of the authors, Ryan Greiser and Francis Walsh, and are subject to change without notice.

Opulus is not responsible for any errors or omissions, nor for any direct, indirect, or consequential damages resulting from the use or reliance on this information. Use of the content is at your own risk. This content is not intended as an offer or solicitation in any jurisdiction where such an offer or solicitation would be illegal.

Wow. A parent of an eleven year old figured in ten years their kid, who’d be three years in college, driving, living by themselves, perhaps owning a car and a gun wouldn’t be capable of managing a nest egg? I guess the first eleven years of raising them didn’t work out?

Sounds a lot more likely they resented the gift and wanted to take it.

A UTMA is super tax efficient way to give someone you love a leg up on life.